What you need to know about Expanded Withholding Tax or EWT?

Expanded Withholding Tax or EWT is a kind of Withholding Tax imposed on income payments and is creditable against the income tax due of the payee for the taxable quarter/year in which the income was earned.

Published: April 17, 2019

Expanded Withholding Tax or EWT is a kind of Withholding Tax imposed on income payments and is creditable against the income tax due of the payee for the taxable quarter/year in which the income was earned.

Who must file the Expanded Withholding Tax Returns?

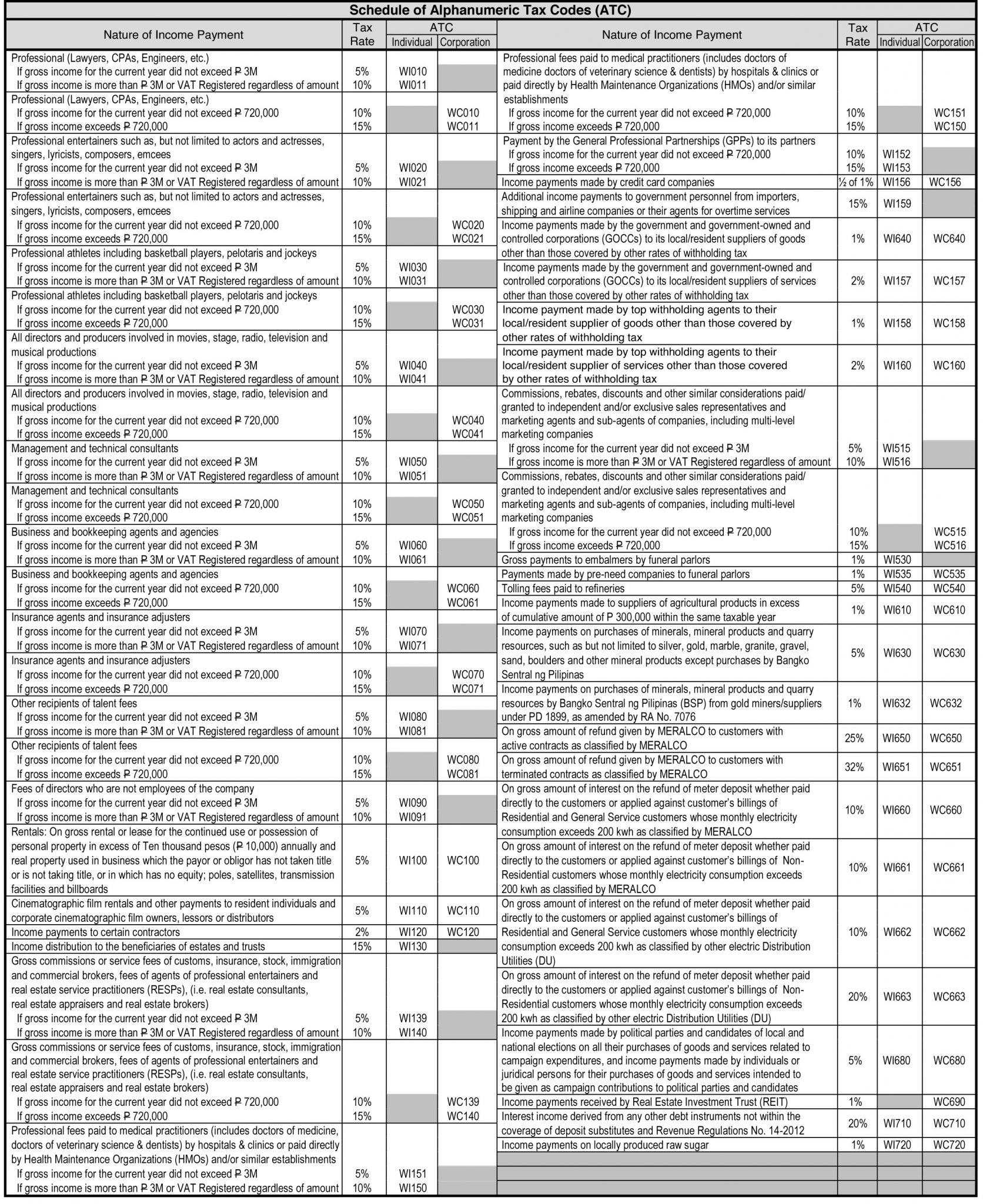

Individuals and entities are required to file the BIR Form No. 0619E or Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded) and BIR Form No. 1601-EQ or Quarterly Remittance of Creditable Income Tax Withheld. And they are the following:

- Individual engaged in business or practice of profession

- Non-individual (corporation, association, partnership) whether engaged in business or not.

- Government agencies and instrumentalities (e.g., National Government Agencies, Government-Owned or Controlled Corporations, Local Government Units, etc.)

List of Tax Rates

Do you know that there is a business software that can do the work for you? Generate BIR Forms instantly with QNE Accounting System!