What is BIR Form 1601EQ?

BIR Form 1601-EQ is the Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded) for every third month of each taxable year.

BRIEF BACKGROUND

The Bureau of Internal Revenue (BIR) issued Revenue Memo…

Published: April 17, 2019

BIR Form 1601EQ is the Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded) for every third month of each taxable year.

BRIEF BACKGROUND

The Bureau of Internal Revenue (BIR) issued Revenue Memorandum Circular (RMC) No. 27-2018, 16 April 2018, to prescribe the new and revised BIR Forms including BIR Form 1601EQ.

The BIR FORM 1601EQ or quarterly withholding tax remittance return shall be filed in triplicate by:

- Individual engaged in business or practice of profession

- Non-individual (corporation, association, partnership) whether engaged in business or not.

- Government agencies and other entities (e.g., National Government Agencies, Government-Owned or Controlled Corporations, Local Government Units, etc.)

The form shall be filed and tax paid on or before the last day of the month following the month in which withholding was made except for taxes withheld.

The return must be filed and tax paid with the Authorized Agent Bank (AAB) of the Revenue District Office.

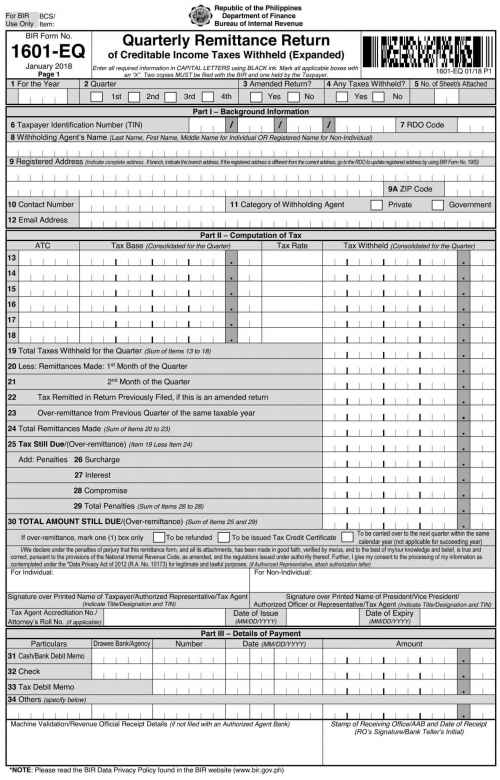

Updated BIR Form 1601EQ Sample Generated in QNE Optimum:

“All background information must be properly filled out.

- The last 5 digits of the 14-digit TIN refers to the branch code

- All returns filed by an accredited tax agent on behalf of a taxpayer shall bear the following information:

- For Individual (CPAs, members of GPPs, and others)

a.1 Taxpayer Identification Number (TIN); and

a.2 BIR Accreditation Number, Date of Issue, and Date of Expiry.

- For members of the Philippine Bar (Lawyers)

b.1 Taxpayer Identification Number (TIN);

b.2 Attorney’s Roll Number;

b.3 Mandatory Continuing Legal Education (MCLE) Compliance Number; and

b.4 BIR Accreditation Number, Date of Issue, and Date of Expiry.”

Great news! Generate BIR Form 1601EQ Sample, BIR Form 2307 and more with QNE Accounting System. Adapt to the fast-changing taxation policies of our country and be BIR-Ready! If you are interested in upgrading to a BIR-Ready Online Accounting System, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!