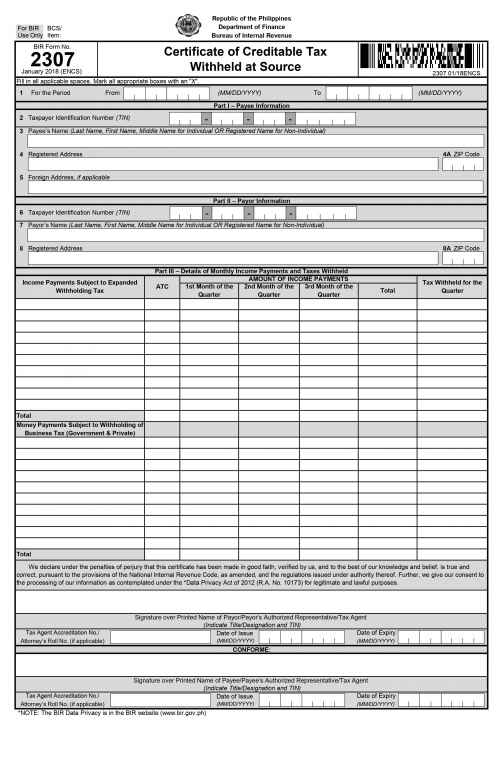

All About BIR Form 2307

Certificate of Creditable Tax Withheld At Source or commonly known as BIR Form 2307 displays the income subjected to expanded withholding tax paid by the withholding agent.

In the Books of Accounts, it is accounted for as an asset…

PUBLISHED: APRIL 22, 2019

Certificate of Creditable Tax Withheld At Source or commonly known as BIR Form 2307 displays the income subjected to expanded withholding tax paid by the withholding agent.

In the Books of Accounts, it is accounted for as an asset, considered as income tax prepayments and being deductible from income tax due of the taxpayer during a quarterly or annual income tax return.

Issuance of BIR Form 2307 is an obligation of the payor and/or employer – withholding tax agent to the payee. While the Payee is required to attach it with their 1701/1701Q forms so that they may claim their Tax Credit.

The certificate is attached to the following with different deadlines:

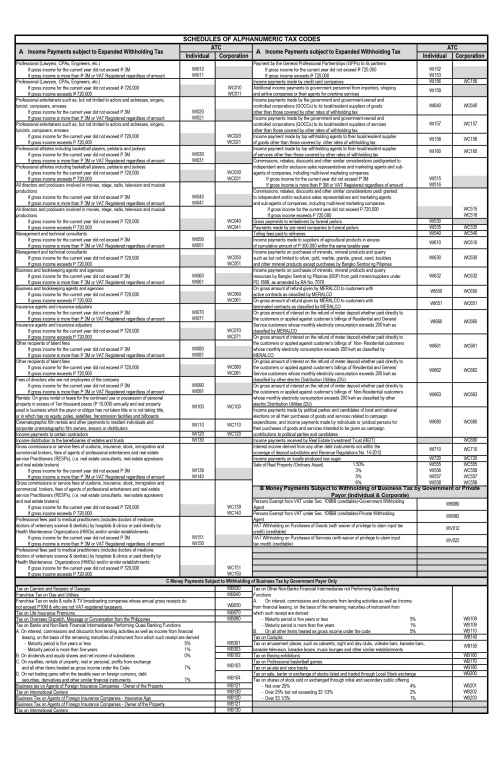

- Expanded Withholding Taxes (EWT) – Must be issued to payee upon request on or before the 20thday of the month following the taxable quarter. At once, payor must provide the statement to payee with the income payment.

- Percentage Tax On Government Money Payments – Must be issued to the payee upon request on or before the 10thday of the month following the month in which the withholding was made. At once, payor must provide the statement to payee with the income payment.

- VAT Withholding – Must be issued to the payee upon request on or before 10thday of the month following the month in which withholding was made. At once, payor must provide the statement to payee with the income payment.

Updated BIR Form 2307 Sample

The BIR Form 2307 Sample can be generated through QNE Accounting System.

Download sample form here.

HOW CAN WE HELP YOU?

In QNE Optimum Accounting System, BIR Form 2307 can be easily generated when the company records the Billing Statements, Purchase Invoices or in Payment Vouchers or Bills. QNE Accounting System also provides accurate values that allows the company or individual to have more time in other tasks. QNE Accounting System will greatly help you prepare your BIR Forms ahead of your deadlines!

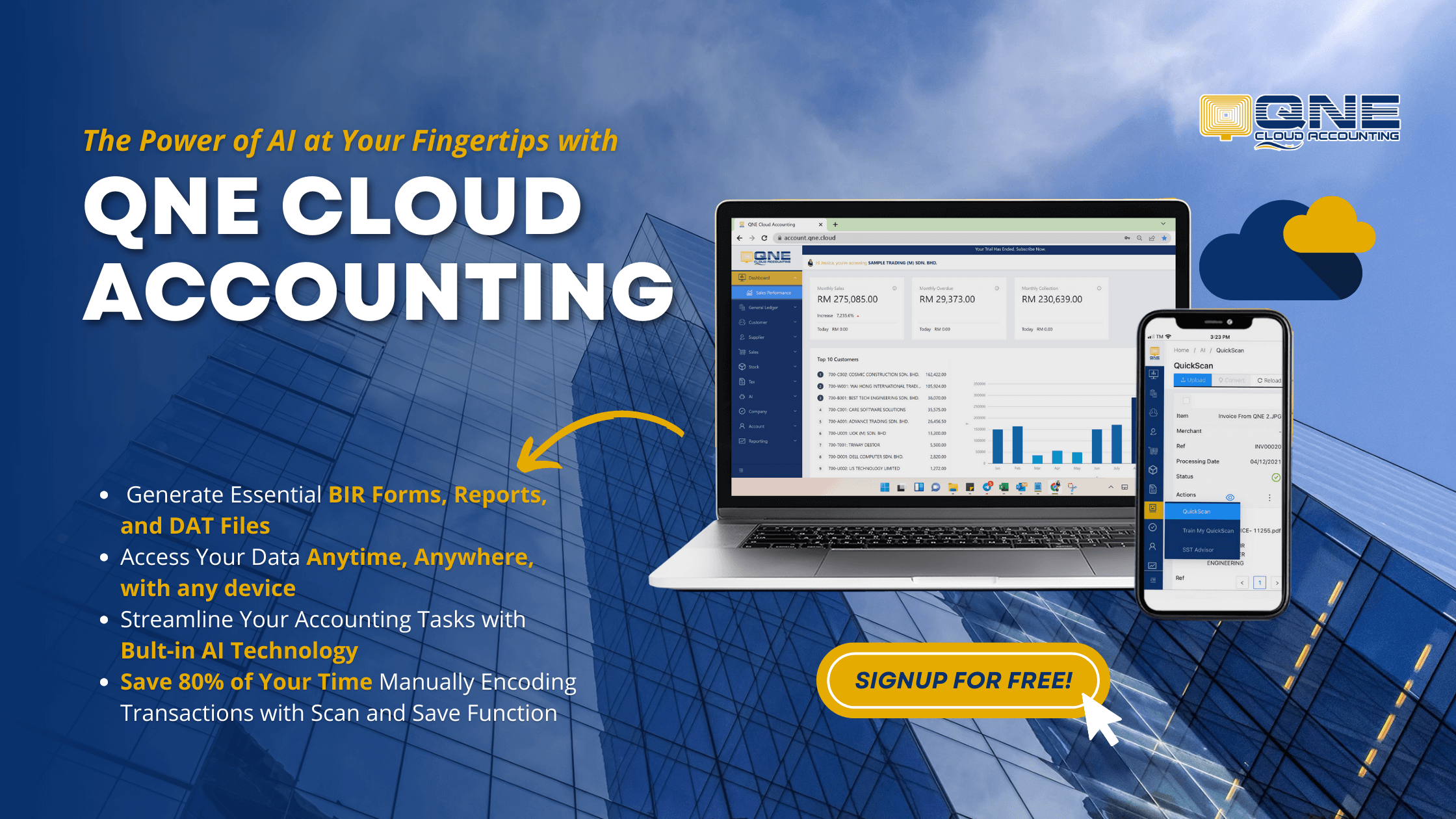

If you are interested in upgrading to a BIR-Ready Online Accounting System, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!