Summary Listing of Sales and Purchases (SLSP)

PUBLISHED: June 30, 2021

The Summary Listing of Sales and Purchases also known as SLSP is one of the documentary requirements that the BIR requires all VAT-registered taxpayer to submit as an attachment to their VAT return.

WHO MUST FILE?

All VAT taxpayers with a total of quarterly sales or receipts exceeding ₱2,500,000.00 are obliged to submit quarterly summary list of sales. Whereas those with a total of quarterly purchases exceeding ₱1,000,000.00 are required to submit quarterly summary list of purchases.

WHEN TO FILE SLSP?

BIR requires all VAT-registered taxpayers to submit the Summary Listing of Sales and Purchases (SLSP) on a quarterly basis not later than the 25th day after the end of each quarter.

Required Details for Summary Listing of Sales and Purchases (SLSP):

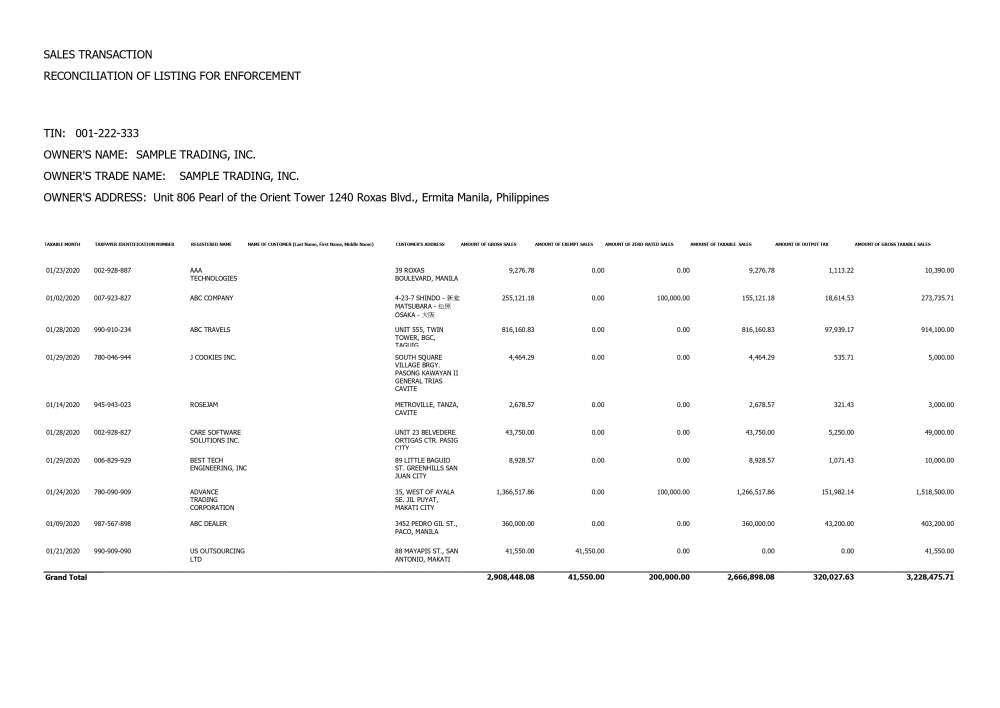

Summary List of Sales (SLS)

-

- BIR Registered Name of the Buyer

- TIN of the Buyer

- Nature of Sales

- Amount of Sales

- VAT Amount

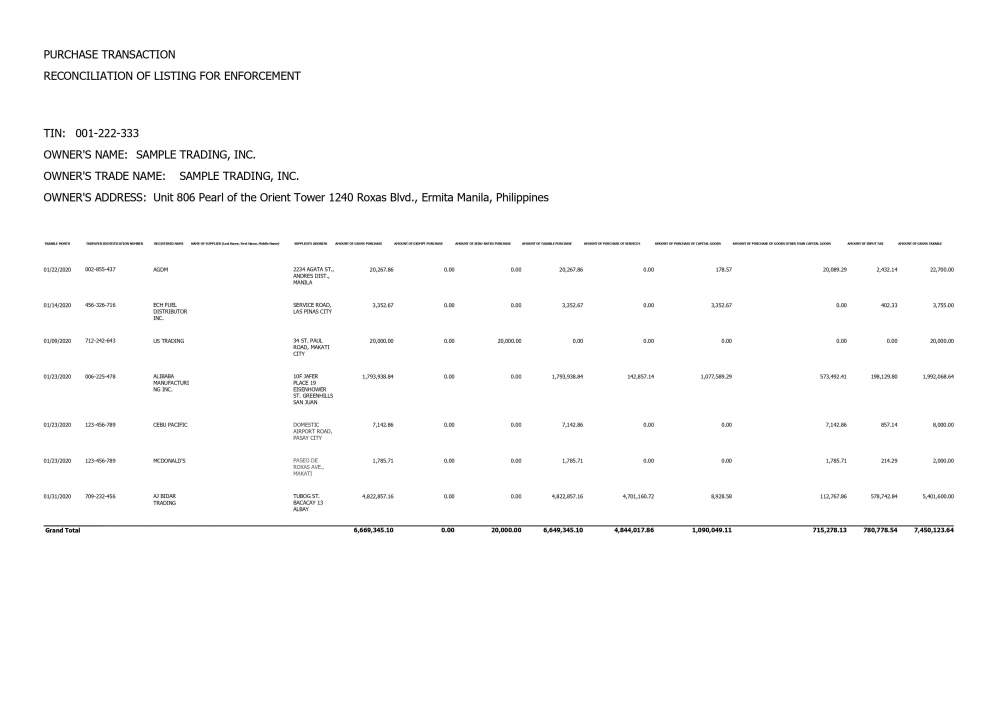

Summary List of Purchases (SLP)

-

- BIR Registered Name of the Supplier

- TIN of the Seller

- Nature of Purchase

- Amount of Purchase

- Creditable Input VAT and/or Non-creditable Input-VAT

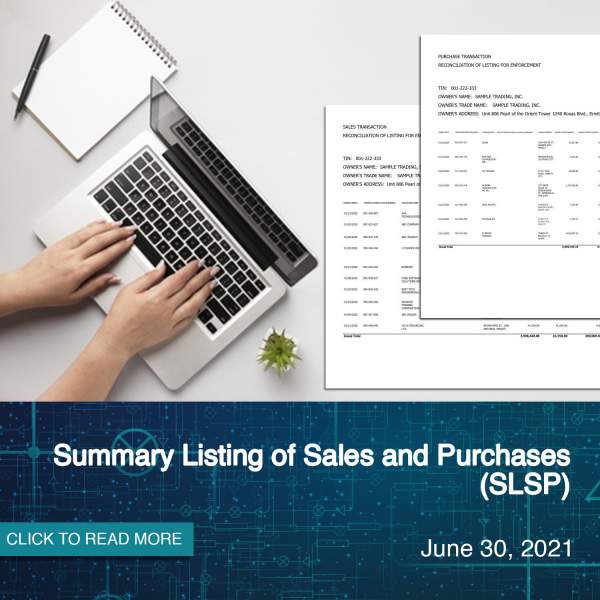

SLSP SAMPLE

Sample SLS and SLP report generated in the QNE Optimum Accounting System.

(Click to zoom images)

Generate Summary Listing of Sales and Purchases (SLSP) in the QNE System by following these steps:

- Go to Reports –> VAT Reports –> VAT Detail Listing

- Filter the Date and Others

- Select format – Sales, Purchases, Importation, VAT Detail Listing, and VAT Summary

HOW TO FILE SLSP?

BIR provides a downloadable program wherein taxpayers can input the details mentioned above to verify the details. Encoding on the daily or weekly basis will be a help for the taxpayer to avoid pilling number of invoices or receipts. With an accounting system, taxpayers can automatically generate SLS and SLP reports in just a few clicks as the system captures all the data that is being encoded.

THE USE OF SLSP

When a seller declared a sale but the buyer did not declare the same as purchase, BIR will use the SLSP to recognize tax payers who will allegedly under declare taxes. All the data generated from Summary Listing of Sales and Purchases (SLSP) reports will be used by the bureau to match the sales and purchases from all the taxpayers who submitted the same requirements.

Filling BIR Forms and Reports should be as easy as 1, 2, and 3, with QNE!

If you are interested in upgrading to a BIR-Ready Online Accounting System, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!