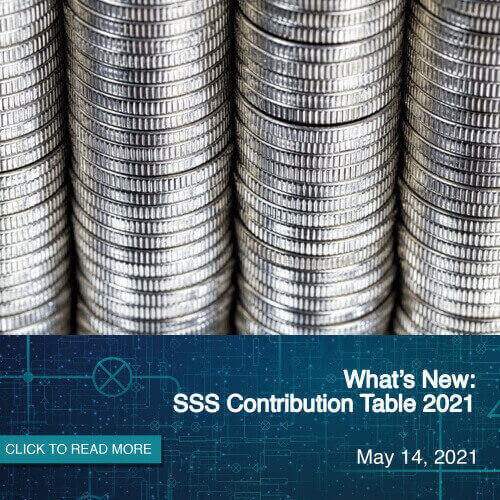

What’s New: SSS Contribution Table 2021

PUBLISHED: May 14, 2021

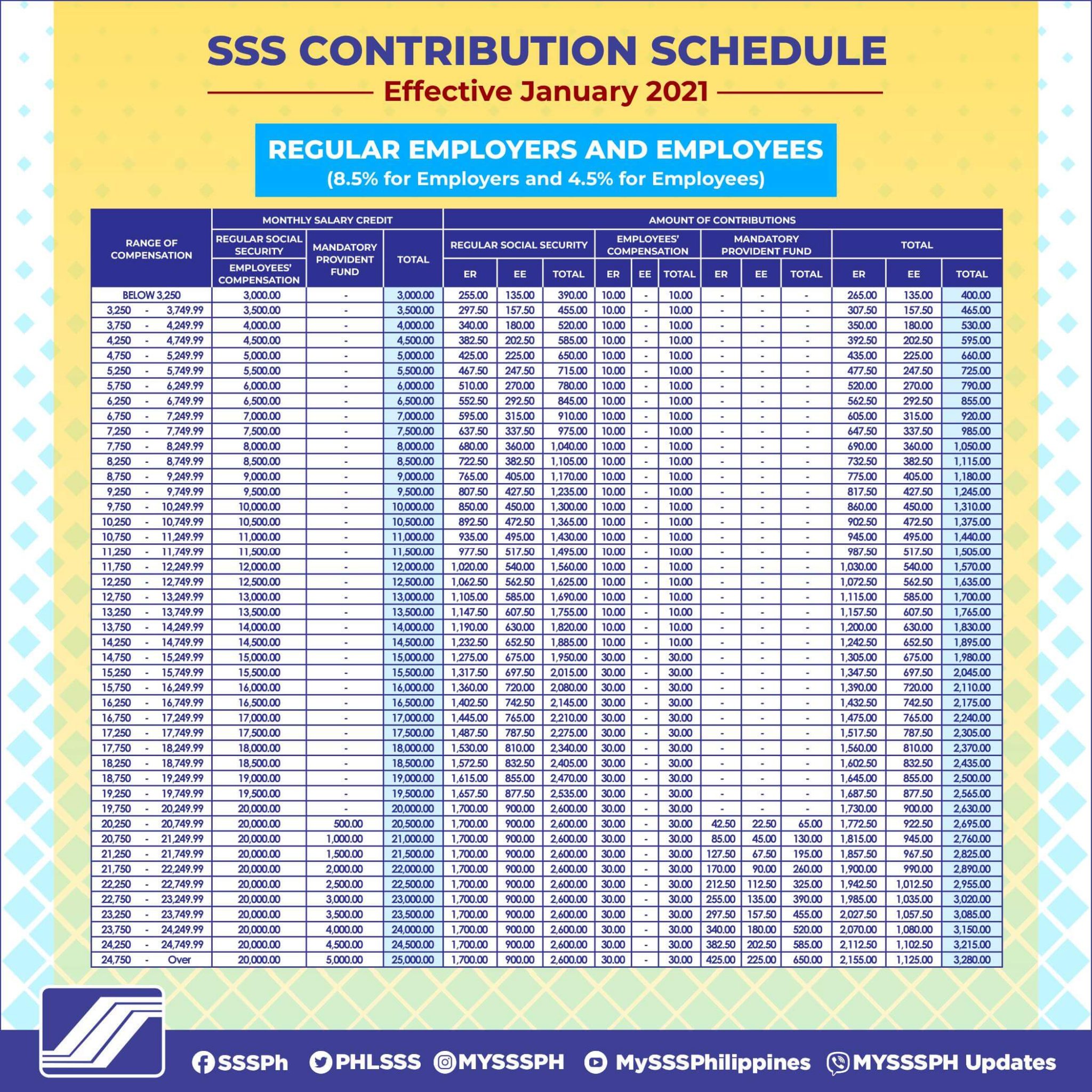

In line with the SSS New Contribution Table 2019, SSS Contribution Table 2021 started to take effect last January 2021. This is in pursuant with the Republic Act No. 11199, also known as the Social Security Act of 2018 that added 1% to the current 12% contribution that totals to 13%. This also increases the Minimum Monthly Salary Credit (MSC) to ₱3,000 from ₱2,000, and the Maximum Monthly Salary Credit (MSC) to ₱25,000 from ₱20,000 from the previous year.

Summary of the new SSS Contribution Table 2021 according to SSS release.

Download the full file here.

Contributions starting at Monthly Salary Credit (MSC) above ₱20,000 will go to SSS Provident Fund named Workers’ Investment and Savings Program (WISP). This program is also shared between employees and employers while for self-employed individuals, voluntary, and OFW shall be the one to shoulder their WISP contributions. WISP benefits will include retirement pensions, total disability, and death on top of the under the regular SSS program.

MOST ASKED QUESTIONS:

- What is Workers’ Investment and Savings Program (WISP)?

It is an additional saving plan that will provide additional monetary benefits to its members. This program is different from the defined benefit plan where the of the benefit payment amount is known. In WISP, the actual amount of benefit to be paid to the member upon retirement not known in advance. The said amount will depend on the performance of the Provident Fund.

- How much is the WISP contribution?

Employed SSS members with MSC of at least ₱24,750 will be needing to contribute ₱650 to the SSS Provident Fund.

For Households and Kasambahays, their employers will shoulder ₱425 while they will shoulder ₱225 amounting to ₱650 if the MSC is at least ₱24,750.

Other contribution is reflected in the SSS Contribution Table 2021

- How can WISP be processed?

The SSS Provident Fund also know as WISP is processed with regular SSS benefits once a member submits his/her application.

- Who are included in the WISP?

-

- Employed SSS Members

- Household Employees and Kasambahay

- Self-employed SSS Members

- Voluntary Members

- Non-working spouse; and

- All land-based OFWs