QNE SME Cloud Accounting Software for Your Business

A BIR-Ready SME Cloud Accounting

What is QNE SME Cloud Accounting Software FOR SMALL BUSINESS?

QNE SME Cloud Accounting for businesses is the newest and latest addition to QNE Software’s line of product focusing on the requirement of small businesses and startup companies looking for a BIR-ready, user-friendly, and accessible accounting software that can adapt to the fast-changing business landscape.

Managing a business is a struggle itself. Add to that the challenges that all small businesses face from staffing issue, infrastructure, budget, skills down to technology. Running one is a tricky thing to do. Keep your business afloat with QNE SME Cloud Accounting Software!

Why choose QNE SME Cloud Accounting?

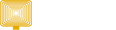

POWERFUL FEATURES YOU DON’T WANT TO MISS

Consolidate Invoices

Create invoices in a breeze! Have custom receipts, make and match payment effortlessly.

Classify Customers

Have all your customers’ data in one place. Generate essential reports like Customer Listing, Customer Ledger, Receipt Listing, Debit and Credit Note, Statement of Account, Customer Aging, and more.

Organize Suppliers

Like your customers, keep your suppliers’ data consolidated. Generate important reports such as Supplier Listing, Bill and Pay Bill Listing, Bill and Payment Voucher, Supplier Aging, and more.

Bank reconciliation

Reconcile your bank and keep your financial data up to date.

BIR Compliant (VAT & WTAX)

Never miss any deadline with QNE SME Cloud Accounting Software and have the capability to generate BIR Forms, Reports, Certificates, and DAT Files such as BIR DAT File (SLS, SLP, SAWT, QAP), BIR Forms (2307, 2550M, 1601E, 1604E, SRS) with ease.

Pay Bills

Pay outstanding bills on time and have a clear view of your cashflow.

Take a peak at QNE SME Cloud Accounting!

SIGN UP NOW TO GET FREE ACCESS TO QNE SME CLOUD ACCOUNTING SOFTWARE FOR YOUR BUSINESS

Here’s what our clients have to say…

Be part of the thousands of satisfied QNE Partners! #QNExperience