PAG-IBIG Fund Update: Implementation of Increase in the Maximum Fund Salary (MFS) Effective February 2024

PUBLISHED: January 26, 2024

Disclaimer: QNE Software published this PAG-IBIG Fund Update: Implementation of Increase in the Maximum Fund Salary (MFS) Effective February 2024 blog to inform the readers. This blog only serves to provide valuable information and thus QNE cannot be held liable for any error that readers may commit that will result to misinterpretation or other related causes. It can and will change anytime without prior notice in accordance to PAGIBIG.

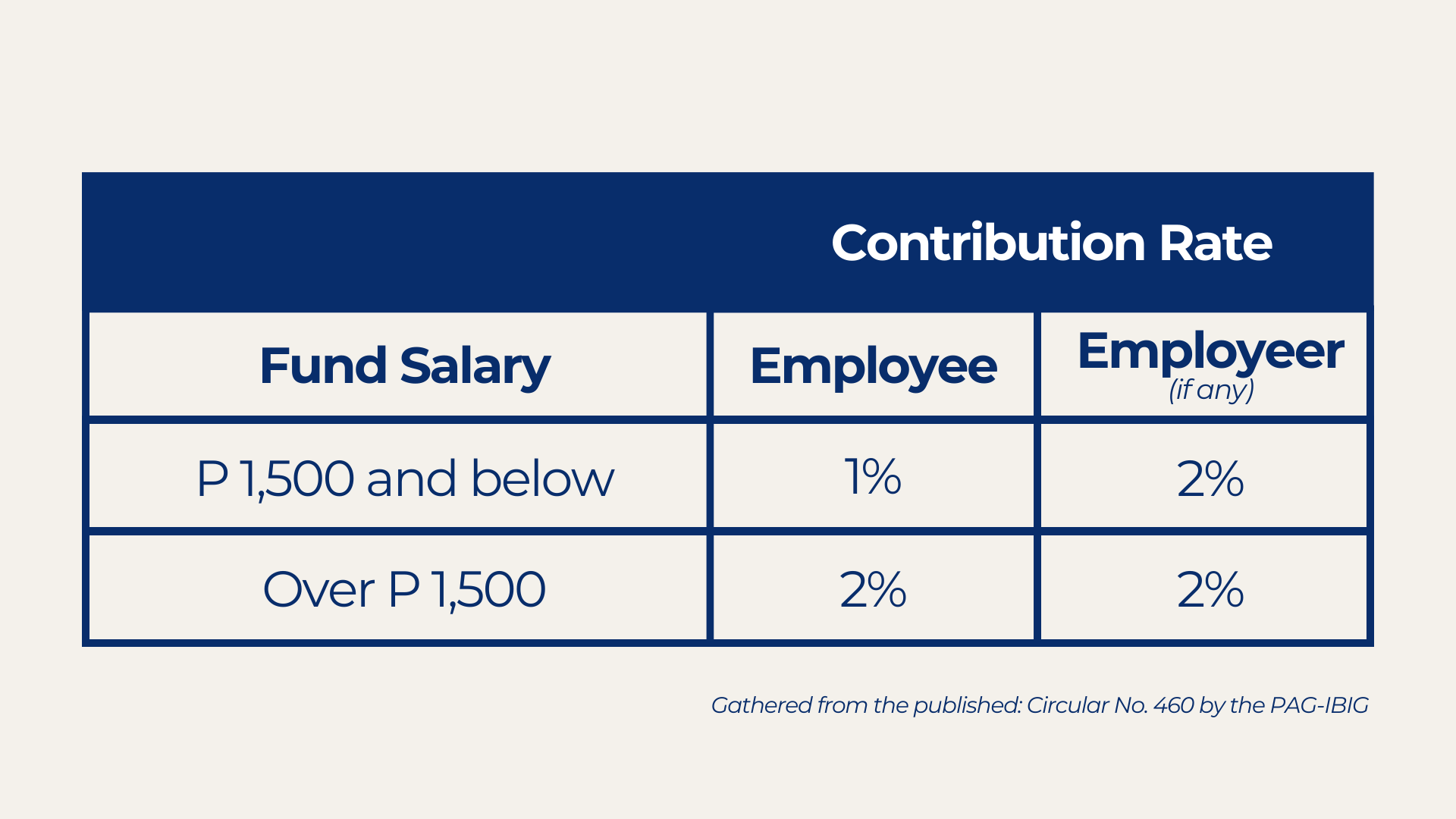

Heads up to our payroll masters and preparers! The PAG-IBIG or Home Development Mutual Fund (HDMF) has recently released a new guideline for the implementation of the increase in the maximum fund salary (MFS) to be followed and take effect on February 2024. Circular No. 460 stipulates the changes and updates that both the employee and employer should abide by.

First, let us define what is “Fund Salary”. According to PAG-IBIG, “Fund Salary” shall refer to the basic salary and other allowances, where basic salary includes, but is not limited to, fees, salaries, wages, and similar items received in a month. It shall mean the remuneration or earnings, however designated, capable of being expressed in terms of money, whether fixed or ascertained on a time, task, or piece or commission basis, or other method of calculating the same, which is payable by an employer to an employee or by one person to another under a written or unwritten contract of employment for work done or to be done, or for services rendered or to be rendered. (Circular No. 460)

The circular states that the Maximum Fund Salary (MFS) used for both employee and employee savings has been increased to Ten Thousand Pesos (PHP 10,000) from Five Thousand Pesos (PHP 5,000).

This was in accordance to the Section 7 of Republic Act No. 9679 wherein the financial calculations and rates of benefits are provided.

The circular also states that employers are not allowed to deduct employer contributions from the employee wages or other compensation, nor to seek reimbursement of such contributions in any other way. Employers must pay two (2) percent of the contributing member’s monthly fund salary as a counterpart contribution.

In addition, employees who have two (2) or more employers shall contribute monthly to the fund a percentage of their Fund Salary per employer. This contribution is matched by the letter at the percentages outlined in Item C Section 1 of the Circular. Implementation of Increase in the Maximum Fund Salary (MFS) shall be effective on February 2024

Abide by the latest Implementation of Increase in the Maximum Fund Salary and make your business compliant to avoid any penalties. If you are looking for a government-compliant, BIR-Ready and CAS Accounting Software, take your accounting to a whole new level and unleash the power of QNE AI Cloud Accounting Software. Claim your FREE Cloud Accounting Plan now!