Need to Know: BIR Form 2550Q (2023)

PUBLISHED: May 24, 2021 | UPDATED: May 23, 2023

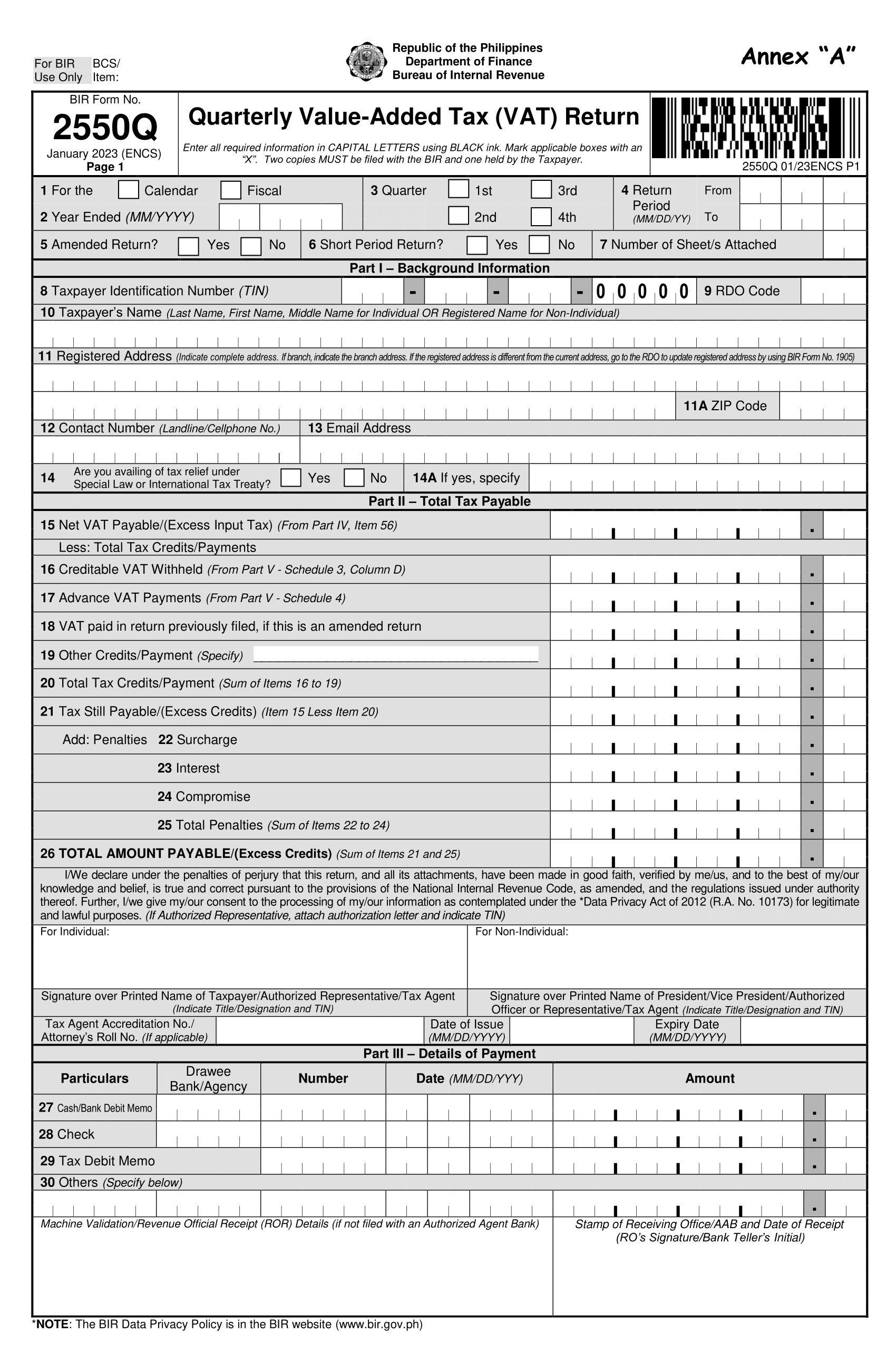

Similar to BIR Form 2550M, BIR Form 2550Q also known as the Quarterly Value-Added Tax Return is a form imposed on sales goods and services. An indirect tax (VAT) that is passed to the buyers who consumes the products and services.

VAT or Value Added Tax is an indirect tax which is passed to the buyer who consumes the goods or services.

This form shall be filed in triplicate by the following taxpayers;

-

- VAT-registered person; and

- A person required to register as a VAT taxpayer but failed to register.

This document must be filed by the above-mentioned taxpayers as long as the VAT registration has not been cancelled yet, even if there is no taxable transaction during the month or the aggregate sales for any 12-month period did not exceed the threshold of ₱1,500,000.00.

This form shall be filed not later than the 25th day following the close of each taxable quarter. The “Taxable Quarter” term means the quarter that is corresponding to the income tax quarter of the taxpayer.

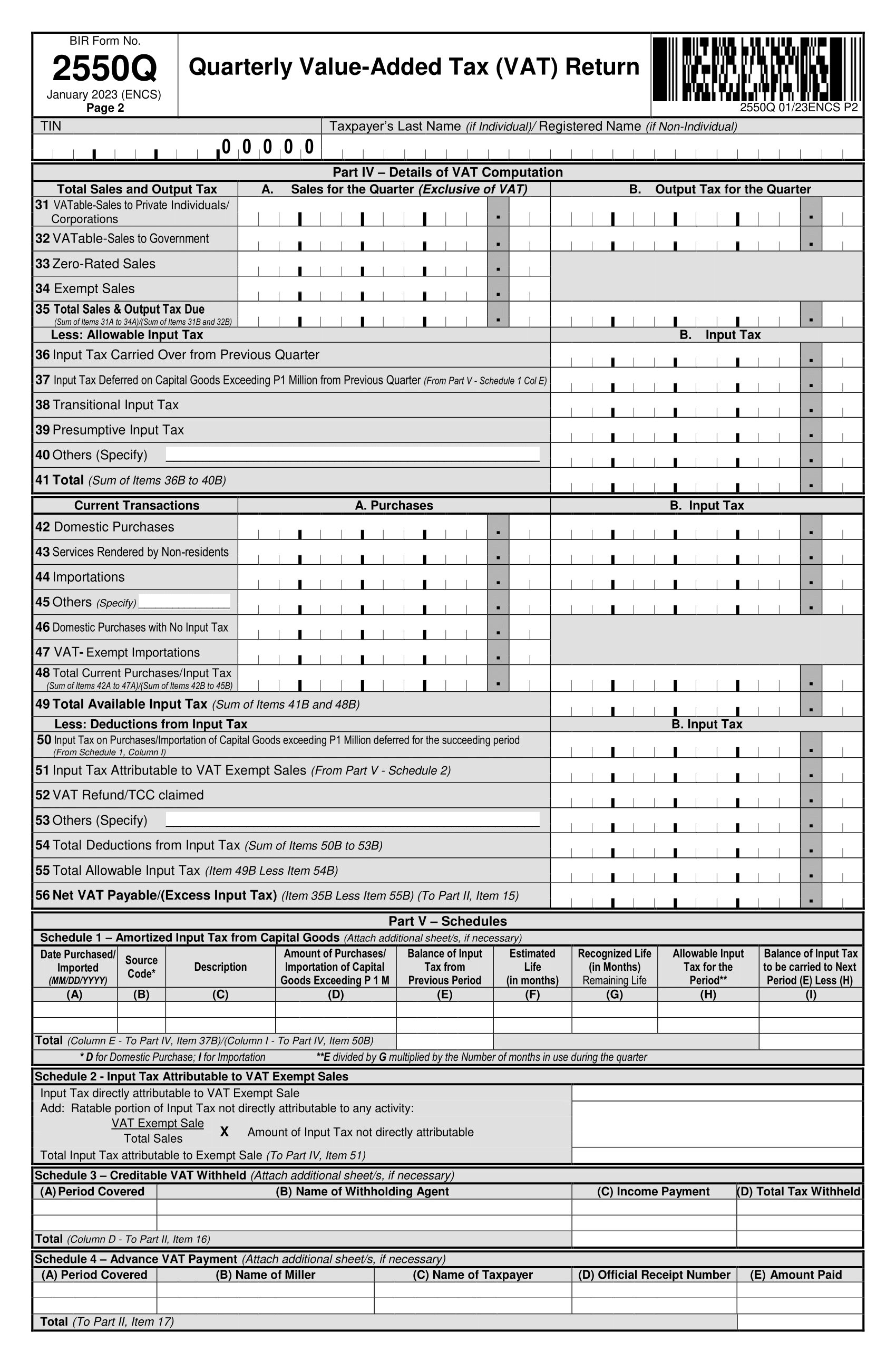

Updated BIR Form 2550Q Sample (Download to see full size)

*This form sample will be available on QNE Accounting System on the coming version release.

As of May 19, 2023 the latest 2550Q Form is available on the BIR Website (RMC 59-2023) for download but have yet to be available in the Electronic Filing and Payment System (eFPS) and Electronic Bureau of Internal Revenue Forms (eBIRForms). A separate issuance shall be released once the new BIR Form 2550Q is available on both eFPS and Offline eBIRForms Package. For the meantime, the existing form shall be used in the said platforms in filing and paying VAT.

In QNE Optimum Accounting System, BIR Form 2550Q, BIR Form 1601EQ and other BIR Forms and Reports can be easily generated when the company records the Billing Statements, Purchase Invoices or in Payment Vouchers or Bills. QNE Accounting System also provides accurate values that allows the company or individual to have more time in other tasks. QNE Accounting System will greatly help you prepare your BIR Forms ahead of your deadlines!

If you are interested in upgrading to a BIR-Ready Online Accounting System, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!