A Guide to Income Tax Returns Philippines

PUBLISHED: August 30, 2021

Defining Income Tax Returns Philippines

Income Tax Return or ITR is a form of tax that taxpayers file with the BIR to report their income, expenses, and other important information such as profits arising from property, tax liability and any refund for excess payment of taxes.

Who needs file Income Tax Returns Philippines?

| Individuals | Non-individuals |

| Resident citizens who are receiving income inside and outside of the Philippines. | Domestic Corporations |

| Non-resident citizens who are receiving income inside the Philippines. | Foreign Resident Corporations |

| Resident and non-resident aliens who are receiving income inside the Philippines. | Partnership |

| Estates and Trusts engaged in trade or business |

Who are exempt from Income Tax Returns Philippines?

| Income from abroad of a non-resident citizen who is: | Overseas Filipino Worker, including overseas seaman |

| A citizen of the Philippines who establishes the fact of his physical presence abroad with a definite intention to reside therein | An individual citizen of the Philippines who is working and deriving income from abroad as an overseas Filipino worker is taxable only on income from sources within the Philippines |

| A citizen of the Philippines who leaves the Philippines during the taxable year to reside abroad, whether as an immigrant or for employment on a permanent basis | A seaman who is a citizen of the Philippines but receives compensation for services rendered abroad as an affiliate of a vessel engaged exclusively in an international trade |

| A citizen of the Philippines who works and derives income from abroad and whose employment requires him/her to be physically present abroad most of the time during the taxable year |

Methods of Filling Income Tax Returns Philippines

- Manual Filling – this method of filling requires taxpayers to go to the dedicated Authorized Agent Bank or ABB by the taxpayer’s RDO.

- Electronic Filling and Payment System (eFPS) – this is done by filling and paying the returns online.

- Electronic BIR Forms (eBIRForms) – this the digital filling process by non-eFPS and Accredited Tax Agents or ATA.

Deadline of Filling Income Tax Returns

Taxpayers must file their annual Income Tax Returns on or before April 15 following the close of each taxable year. Take note that there are some Income Tax Returns that has different deadlines under the requirements of the National Internal Revenue Code (NIRC) of 1997.

There are many accounting software available in the market that will greatly help a company manage its accounts and comply with government taxation policies.

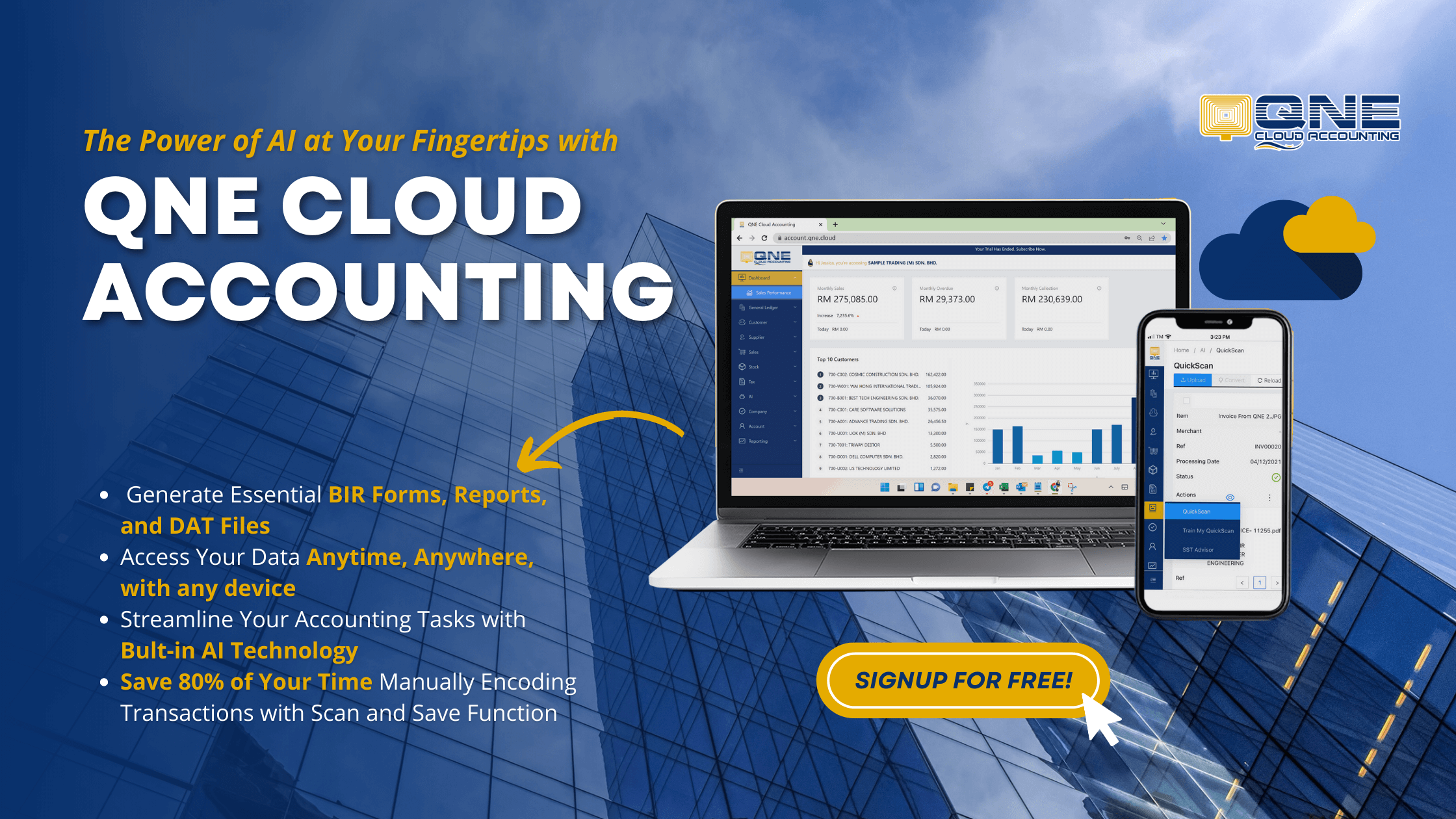

Filling BIR Forms and Reports should be as easy as 1, 2, and 3, with QNE!

If you are interested in upgrading to a BIR-Ready Online Accounting System, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!