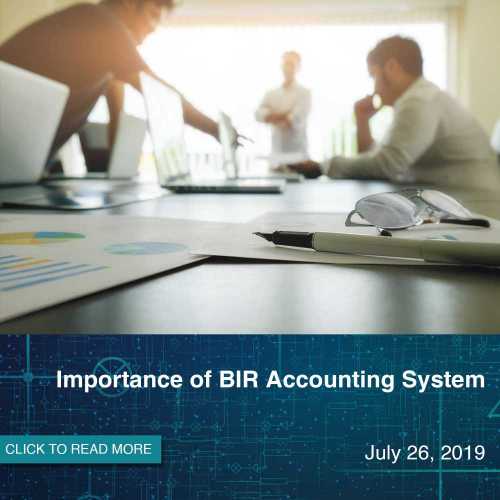

Importance of BIR Accounting System

BIR Accounting System is one of the less prioritized business essentials in the Philippines especially to the Small and Medium Enterprises (SMEs). Reasons include Budget, Manpower and Lack of information.

Most of the SMEs are left in the…

Published Date: July 18, 2019

BIR Accounting System is one of the less prioritized business essentials in the Philippines especially to the Small and Medium Enterprises (SMEs). Reasons include Budget, Manpower and Lack of information.

Most of the SMEs are left in the comfort of using manual bookkeeping not knowing the benefits of having a BIR Accounting System. In this article, we will cite the importance of acquiring a BIR Accounting System.

Why BIR Accounting System is an Essential Business Tool?

- Customer Trust – Customers are the first in line when in comes to business priorities. Business’ mission is simply how to deliver the client’s needs and be of significance to them. Being compliant with the Bureau of Internal Revenue (BIR) gives the customers ease and confidence with the business.

- Avoid Penalties – Running a business with manual bookkeeping is prone to data error and penalties due to incompliance with BIR rulings. Having a BIR Accounting System not just help in managing financial transactions but also making sure that data is accurate in the manner prescribed by the tax authorities.

- Quick Business Decision – For the management it will be easier for them to forecast and arrive to an effective solution if they can quickly view Financial Reports, Sales Status and Purchases. In a BIR Accounting System all these reports are available.

- Adaptability to Philippine Rules and Regulations – Large Taxpayers are required to have a Computerized Accounting System (CAS) that is accredited by BIR, they must comply with the requirements of the Bureau else companies may incur penalties. Businesses must adapt to the rules and regulations to maintain their operations and credibility.

- Company Prestige – Being compliant in BIR Regulations and having a BIR Accounting Software have a positive effect in the company’s profile. By this way clients may develop loyalty towards the company. If the company maintain a good image by government compliance, it will be rewarding for the company in many aspects.

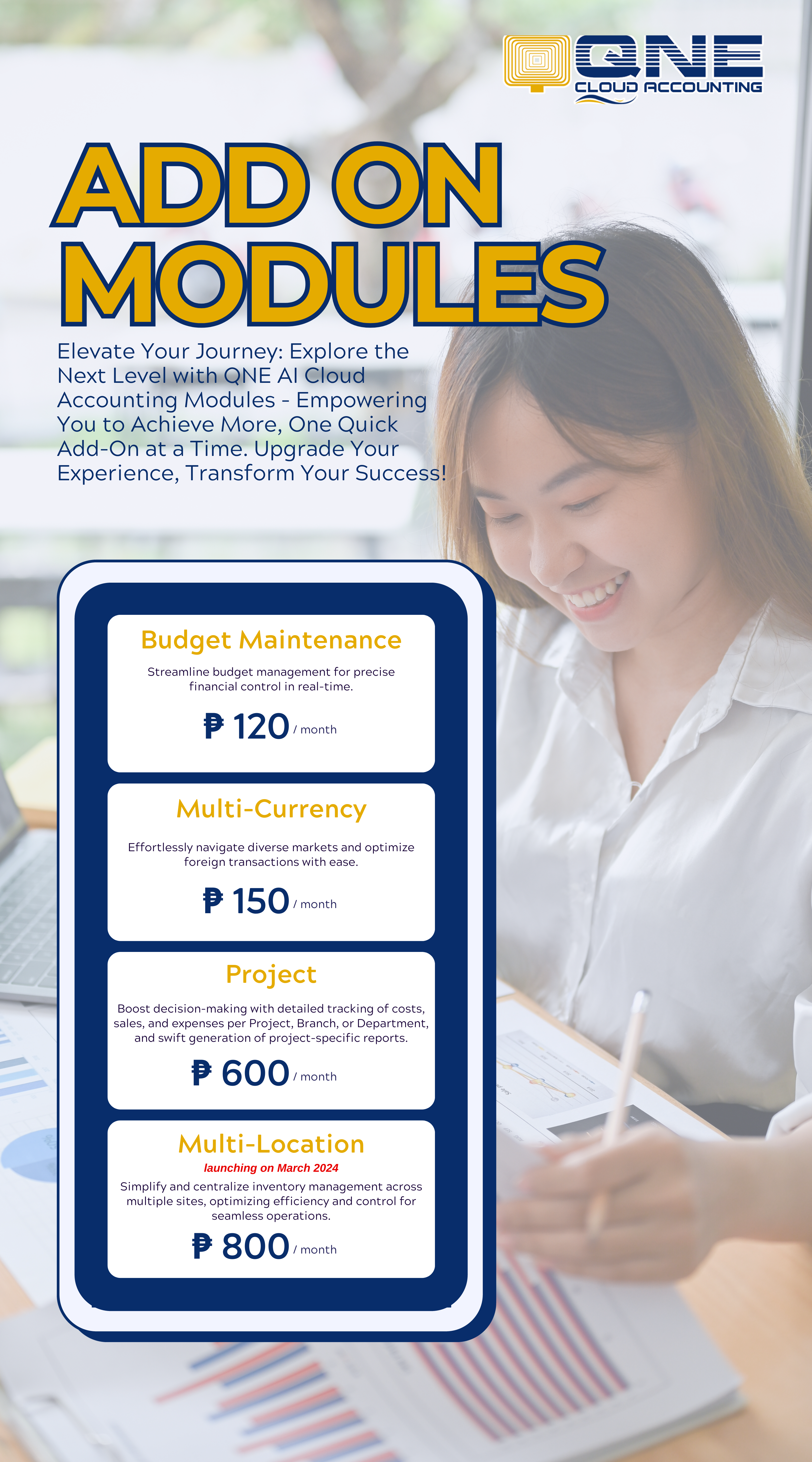

BIR Accounting System in the Philippines

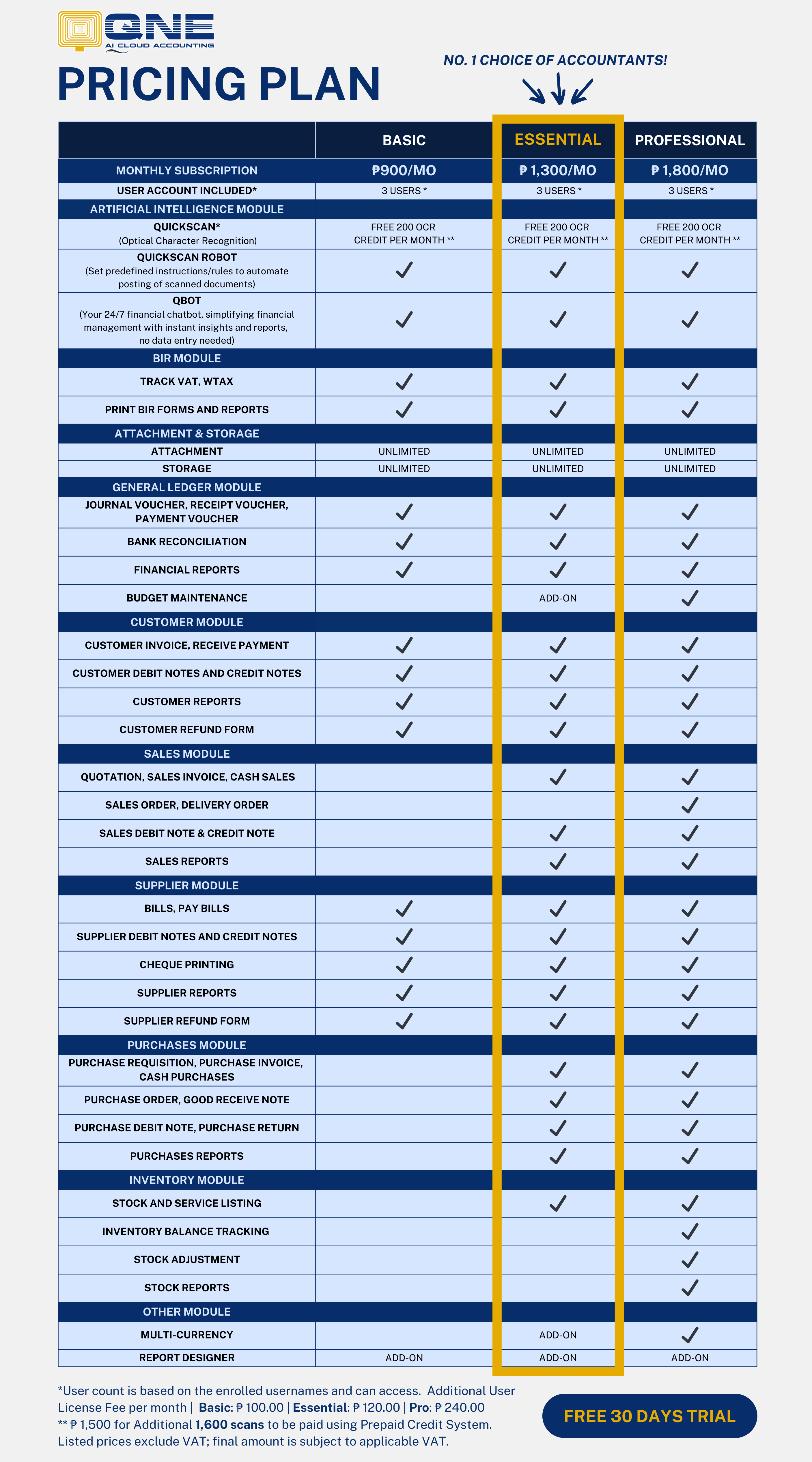

There are many BIR Accounting System providers in the Philippines, one of them is QNE Software Philippines, Inc. QNE Software developed an Accounting System that is complete with the features that adapts to the rules and regulations of BIR with regards to Computerized Accounting System (CAS) accreditation. The company is continuously enhancing their Accounting System to comply with the changes mandated by BIR.

These are some of the available forms and reports in QNE Accounting System:

Financial Reports such as, General Journal, Cash Receipt Journal, Cash Disbursement Journal, Sales Journal, Purchase Journal, General Ledger, Subsidiary Ledger of Debtor, Subsidiary Ledger of Creditor, Trial Balance, Statement of Financial Position and Statement of Comprehensive Income.

BIR Report Summary which includes Summary List of Sales (SLS), Summary List of Purchases (SLP) and Semestral List of Regular Suppliers (SRS).

BIR Data Files like Relief Sales Data File, Relief Purchases Data File, QAP Data File, Annual Witholding Tax Data File (1604E) and SAWT Data File.

BIR Forms and Certificates that comprise BIR Form 2550M, BIR Form 2550Q, BIR Form 1601-EQ, BIR Form 0619-E and BIR Form 1604-E and BIR Certificate 2307.

Looking for a BIR Accounting System? Dial 02 5674248 or 02 5674253 and visit QNE Software Philippines Inc. website for a Free Product Demonstration.