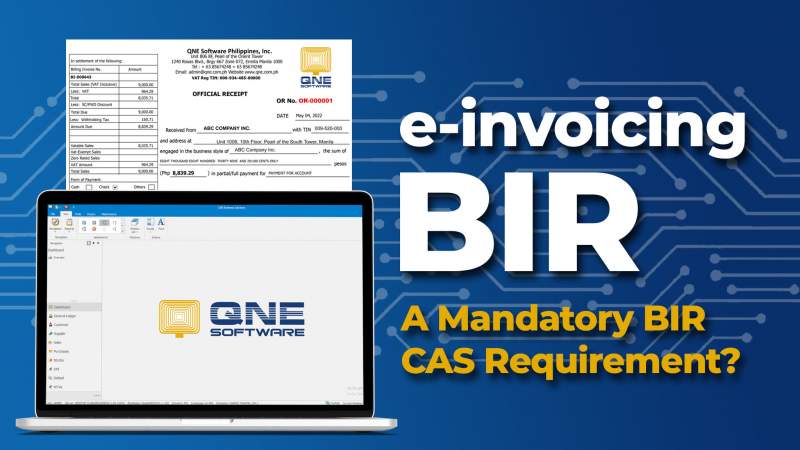

e-Invoicing BIR: A Mandatory Requirement for BIR CAS?

PUBLISHED: May 6, 2022

As we progress to the digital age, bit by bit businesses also start to transition from physical and manual labor to digital process. From automated message responses, simple accounting software, e-invoicing BIR system, to complex ERP Software, many businesses are keeping up with the latest technology in order to be ahead of the competition. In addition to technological challenges faced by business owners, they also have to comply with the vast and fast changing taxation rules and regulations set forth by the BIR.

As part of the TRAIN Law, taxpayers involved in e-commerce, the export of goods and services, and all Large Taxpayers, are required to issue e-invoicing BIR or electronic receipts and report their sales data to BIR within the next five (5) years from the effectivity of the TRAIN law, that is on or before January 1, 2023.

The Philippines was able to develop its electronic invoice reporting system. The e-invoice includes sales invoices, receipts, debit and credit notes and other similar accounting documents issued through the internet. Electronic Invoicing System or EIS is a web-based system the compresses of EIS Taxpayer Portal, EIS Certification Portal, and EIS Portal for Revenue Officers. It is also said to have a facility that will help taxpayers to issue e-invoice/e-receipts that will have its data transmitted to the BIR.

How does e-Invoicing BIR work?

The Bureau of Internal Revenue advances its implementation of the e-invoicing system or EIS. That aims to reduce tax fraud, facilitate Philippine business’ compliance and to streamline the overall business taxation process. The EIS is composed of an invoice report that is sent to the Bureau’s central platform once invoices have been sent to the clients.

In accordance with Revenue Memorandum Order RMO 29-02, taxpayers are required to apply for a complete Computerized Accounting System (BIR CAS) if they are to use e-invoicing and that it should be capable of generating hard copies of the said document at anu given time. While in Revenue Memorandum Circular (RMC) 71-03, e-invoicing is defined as “The electronic invoicing system or e-Invoice System refers to the system developed and maintained by the e-Buyer or e-Seller or both in issuing invoice electronically through the Internet.”

What is included as e-Invoice?

The e-invoicing BIR includes official receipts, sales invoices, debit and credit notes and other similar accounting documents issued via internet.

How can this benefit the businesses?

There are many ways on how this new implementation will benefit a lot of businesses. Some of which are;

- Streamline Business Process

- Fast and Easy Tax Compliance

- Paperless Transactions

- Increased Collaboration in the Company

- Lower the risk of overpayment and fraud and many more

When is the Implementation of e-invoicing BIR?

It is said that it will commence on July of 2022.

Even if the Philippines is far behind from other countries when it comes to e-invoicing BIR and other digital transactions, we have all the resources in order to move forward and achieve digitalization. More details to follow.

If you are interested in upgrading to a BIR-Ready Online Accounting System that has an e-invoicing feature, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!