What are the Books of Accounts in Quick and Simple Explanation?

In this blog, Books of Accounts will be explained in a Quick and Simple way! In the Philippines, the Bureau of Internal Revenue or BIR Requirements for businesses who are registered is to have Books of Accounts. Books of Accounts is any…

Published: OCTOBER 29, 2020

In this blog, Books of Accounts will be explained in a Quick and Simple way!

In the Philippines, the Bureau of Internal Revenue or BIR Requirements for businesses who are registered is to have Books of Accounts. Books of Accounts is any journal, ledger, and supporting vouchers included in a system of accounts. books of account, the original records and books used in recording business transactions.

There are two main books of accounts, Journal and Ledger. Journal used to record the economic transaction chronologically. Ledger used to classify economic activities according to nature.

While as one of BIR Requirements taxpayers are allowed to use three types of Books, Manual books of accounts, loose-leaf books of accounts and computerized books of accounts.

Computerized Books of Accounts

A BIR registered Accounting Software owned by a business, is known as Computerized Accounting Software (CAS). The Books of Accounts generated from the Accounting Software is the one submitted to the agency. CAS is now commonly used because of its many benefits to the Accounting process. It is accurate and fast. Companies may now have quick and reliable way to accomplish BIR requirements with CAS.

Manual Books of Accounts

Manual Books of Accounts are old-style pre-printed journals, ledger, and columnar books. It is in handwritten form.

Usually small entities make us of manual books of accounts because it is less complicated for those who just started a business.

Loose-leaf Books of Accounts

These are printed and bounded journals and ledgers. A printed version of manual books of accounts. Loose-leaf Books of Accounts are simply printed and bounded journals and ledgers. They are the printed version of manual books of accounts.

Loose-leaf books of accounts must be registered with BIR. Taxpayer should also apply for Permit to Use with the agency.

Books of Accounts – Requirements

For Taxpayer engaged in the sale of services:

- General Journal

- General Ledger

- Cash Receipt Journal

- Cash Disbursement Journal

- For Taxpayer engaged in the sale of goods:

- General Journal

- General Ledger

- Cash Receipt Journal

- Cash Disbursement Journal

- Sales Journal

- Purchase Journal

General Journal

While purchases that are made in cash shall be recorded to Cash Disbursement Journal, all purchases on credit shall be recorded in the Purchase Journal.

The following information shall be recorded in every purchase on account:

- Date of purchase

- Vendor/Supplier Name of whom the purchase was made

- Invoice Number as per vendor’s sales invoice

- Description of item purchased

- Accounts payable or amount due to vendor/supplier

- Amount debited to specified account attributable to the purchase (e.g. inventory, purchases, VAT, and others)

- Additional columns may be added depending on the nature of business

Now that you have the Quick and Simple explanation about Books of Accounts. Make sure that you also comply with the rules and requirements of BIR and other Government Agencies.

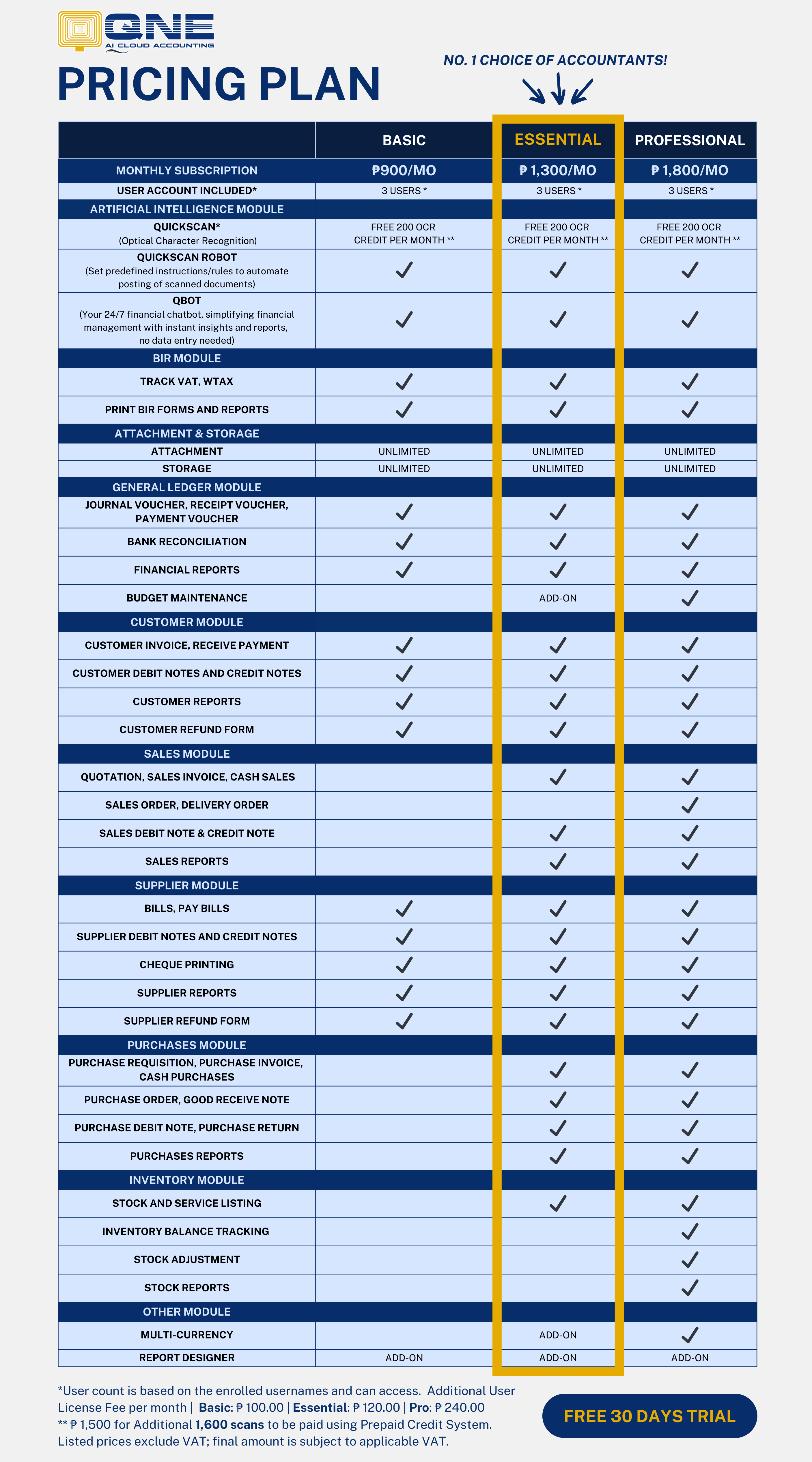

To know more about QNE Accounting Software, QNE Payroll Software and QNE Digital, you may call us at 09177104722 or email us at [email protected]