BIR CREATE Law: What You Need to Know

PUBLISHED: June 3, 2022

Republic Act (RA) No. 11534, also known as the Corporate Recovery and Tax Incentives for Enterprises or BIR CREATE Law was created by the Philippine Congress as a fiscal relief to domestic and foreign corporations doing business in the country in following to the COVID-19 pandemic. BIR CREATE Law pursues to adjust several provisions in the former Tax Code, focusing on the lowering of corporate income tax rates and rationalizing fiscal incentives. This law is estimated to provide private enterprises up to more than 1 trillion pesos worth of tax relief in the coming 10 years.

BIR CREATE Law was signed by President Rodrigo Duterte on March 26, 2021 and took effect on April 11, 2021.

Corporate Income Tax (CIT) under BIR CREATE Law

| TYPE OF BUSINESS | BEFORE CREATE LAW | CREATE LAW |

| Domestic MSME corporations with a taxable income of P5M and below, and with total assets of not more than P100M | 30% | 20% |

| Domestic corporations which earn a taxable income above P5M | 30% | 25% |

| Foreign corporations subject to the regular rate (for nonresident foreign corporations: effective January 1, 2021) | 30% | 25% |

| Percentage tax for non-VAT taxpayers (applicable from July 1, 2020 to June 30, 2023) | 3% | 1% |

| Minimum corporate income tax (applicable from July 1, 2020 to June 30, 2023) | 2% | 1% |

| Non-profit and proprietary educational institutions and hospitals (applicable from July 1, 2020 to June 30, 2023) | 10% | 1% |

| Foreign-sourced dividends received by domestic corporations | 15% | Exempt, subject to reinvestment of earnings in the Philippines |

| Improperly accumulated earnings tax (IAET) | 10% | Repealed |

| VAT on the sale of importation of capital equipment and raw materials for PPE production | 12% | Exempt |

| VAT on the sale of importation of all prescription drugs, medical supplies, devices, and equipment for COVID-19 | 12% | Exempt |

| VAT on the sale or importation of vaccines for COVID-19 | 12% | Exempt |

| VAT on e-books | 12% | Exempt |

| VAT on the sale and importation of prescription drugs on cancer, mental illness, tuberculosis, and kidney-related diseases | 12% | Exempt |

Table from: Department of Finance

It is really hard for companies to thrive and survive during the pandemic and the efforts of the government has a significant impact to them, it is a relief to know and have such regulations to help them overcome these challenges. And with the ongoing digitalization, it is also vital to invest on business software to help manage the business seamlessly.

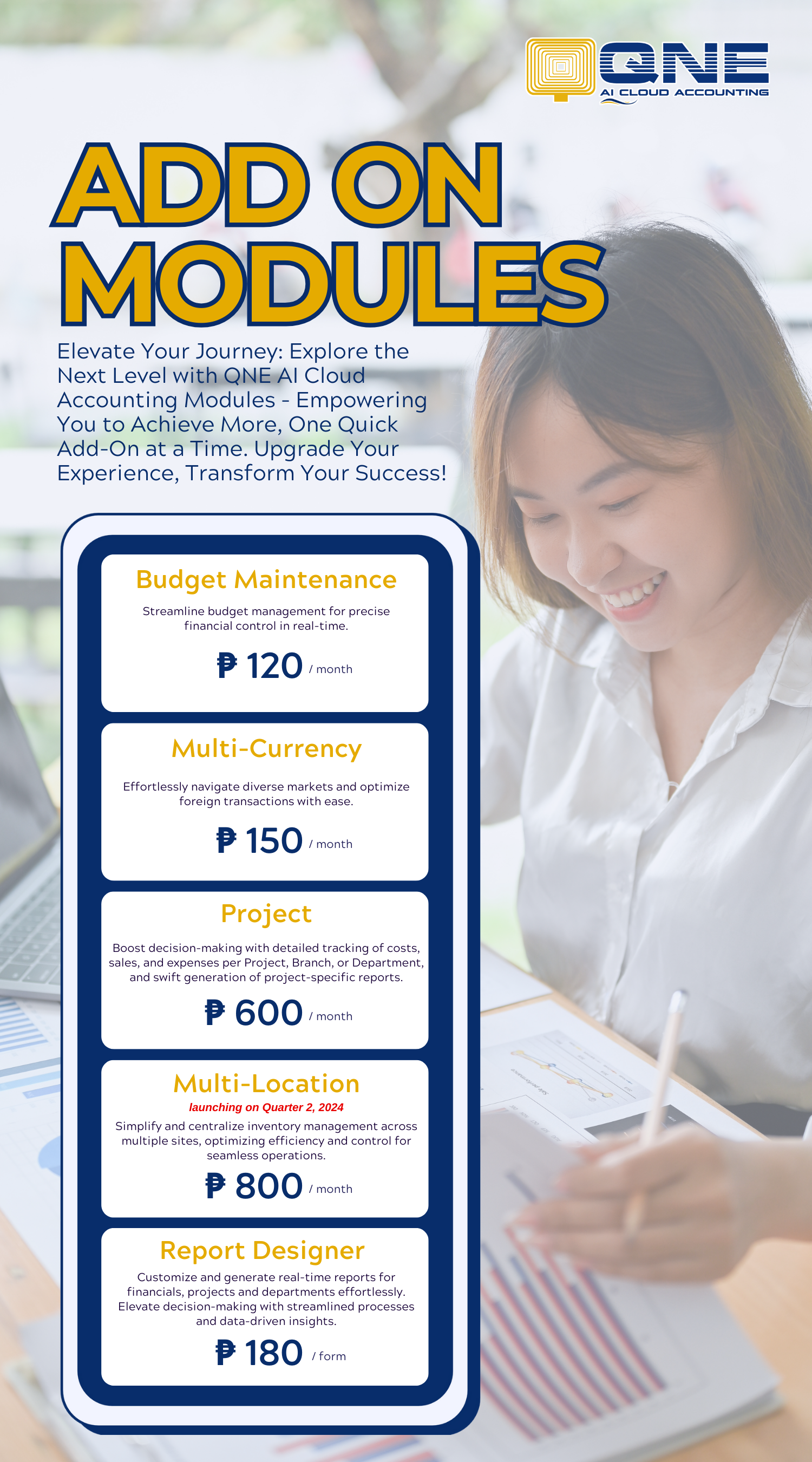

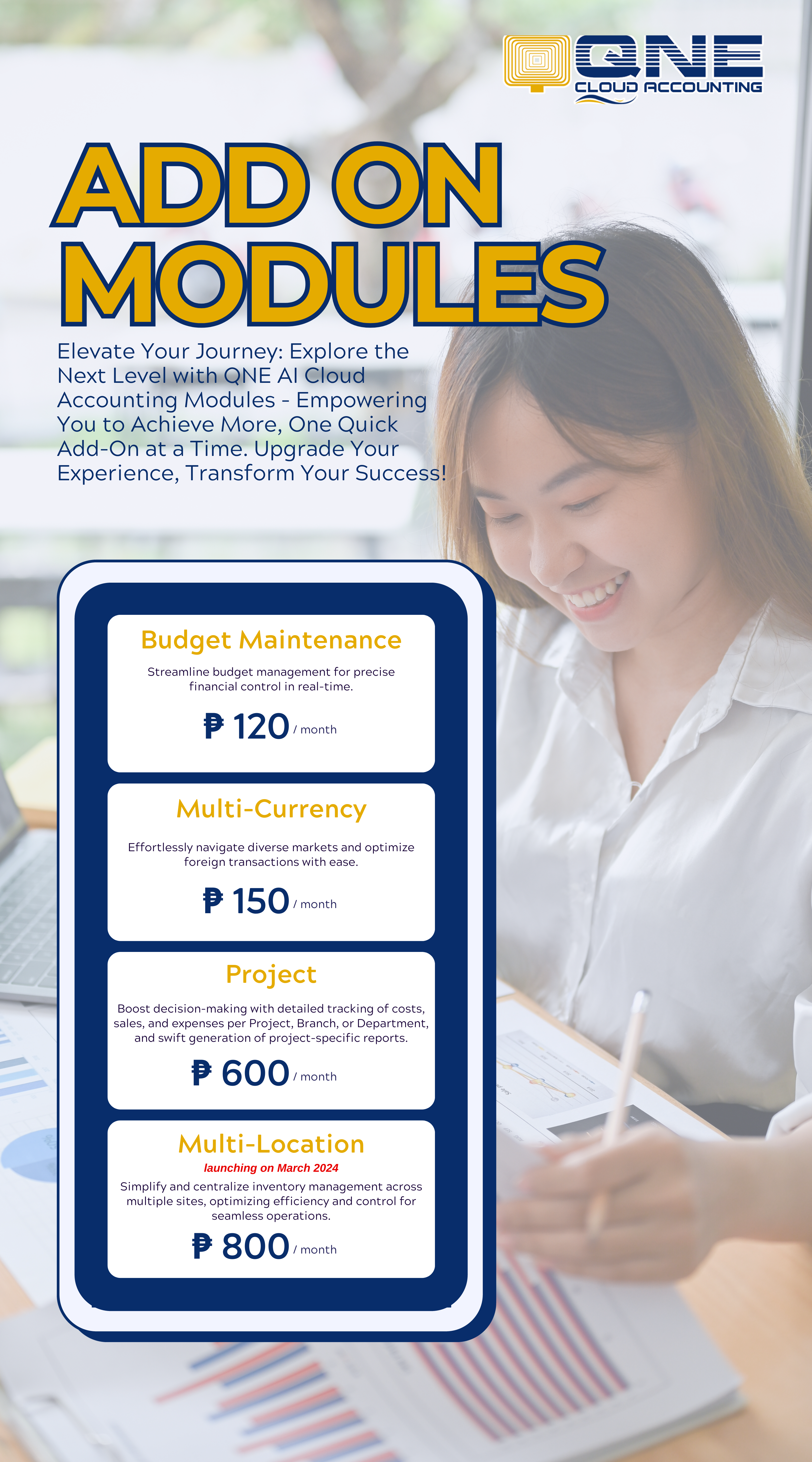

If you are interested in upgrading to a BIR-Ready Online Accounting System, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!