BIR Calendar 2022: Filling, Payments, Deadlines

PUBLISHED: May 20, 2022

Even though tax season has passed, it is important to keep in mind the significant dates that BIR has set with regard to BIR Calendar 2022. Electronic filling and payment system is the meaning of the acronym eFPS. e-Filling is defined as the process of filling or submitting BIR documents through the use of internet via application or software. While e-payment is defined as the process of paying tax liabilities through the internet through Authorized Agent Banks (AABs). In short, BIR eFPS is the system created and sustained by the BIR for electronically filing tax returns, including attachments, if there are any, and paying taxes, with the use of the internet.

Disclaimer: QNE Software published this BIR Calendar 2022 blog to inform taxpayers of the BIR’s filing dates. This BIR Calendar 2022 only serves to provide valuable information and thus cannot be held liable for any error that clients may commit that will result to misinterpretation or other related causes. It can and will change anytime without prior notice in accordance to BIR.

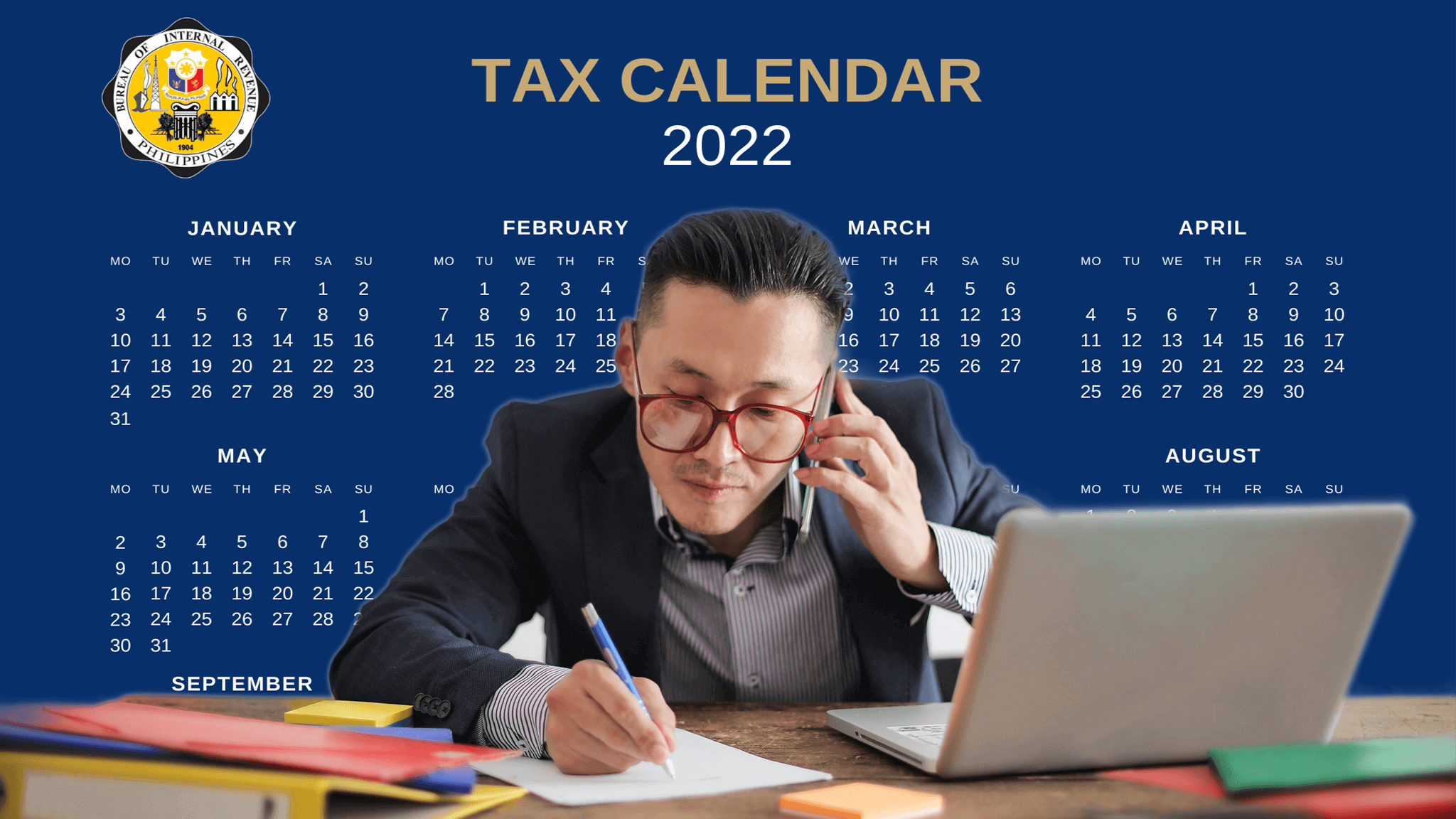

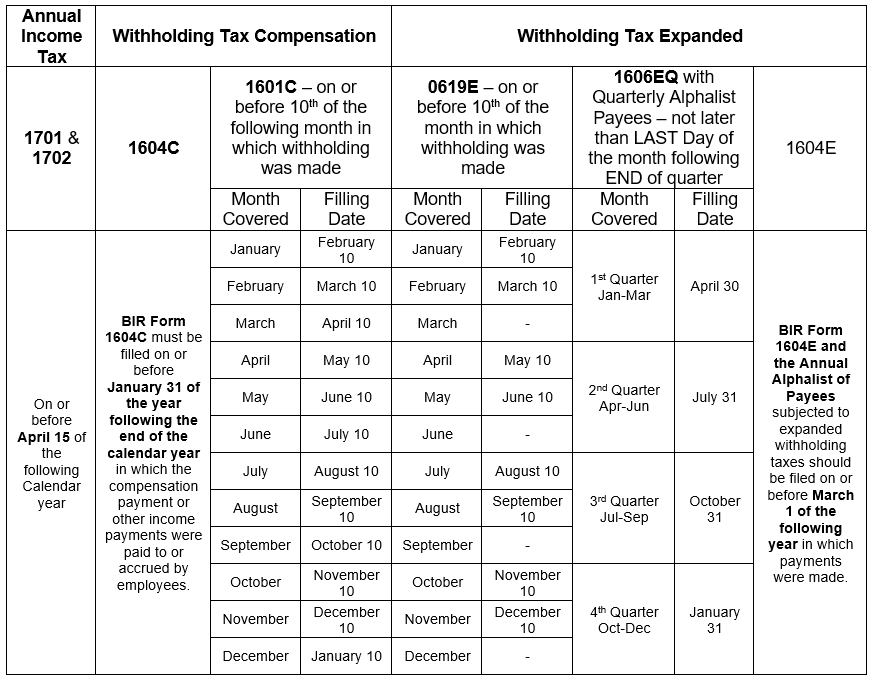

BIR Calendar 2022 Table

This BIR Calendar 2022 is the summarized forms and reports that taxpayers should abide by. Click to see the full list of the BIR Tax Calendar 2022.

It is important not just keep these dates in mind but as well as having the right accounting system software to efficiently manage accounts and governmental reports at the same time.

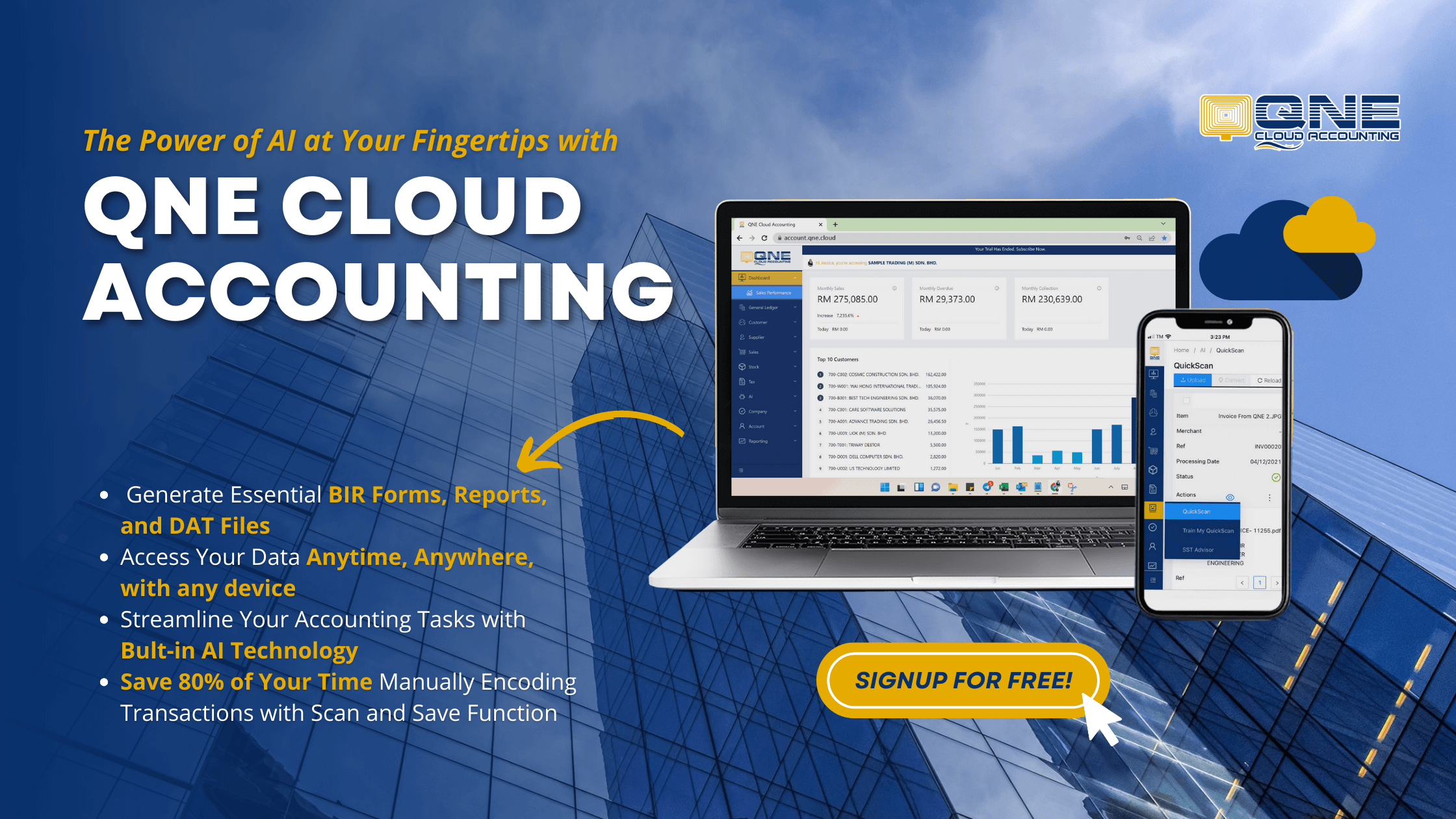

If you are interested in upgrading to a BIR-Ready Online Accounting System, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!