BIR Accounting Software: What You Need to Know

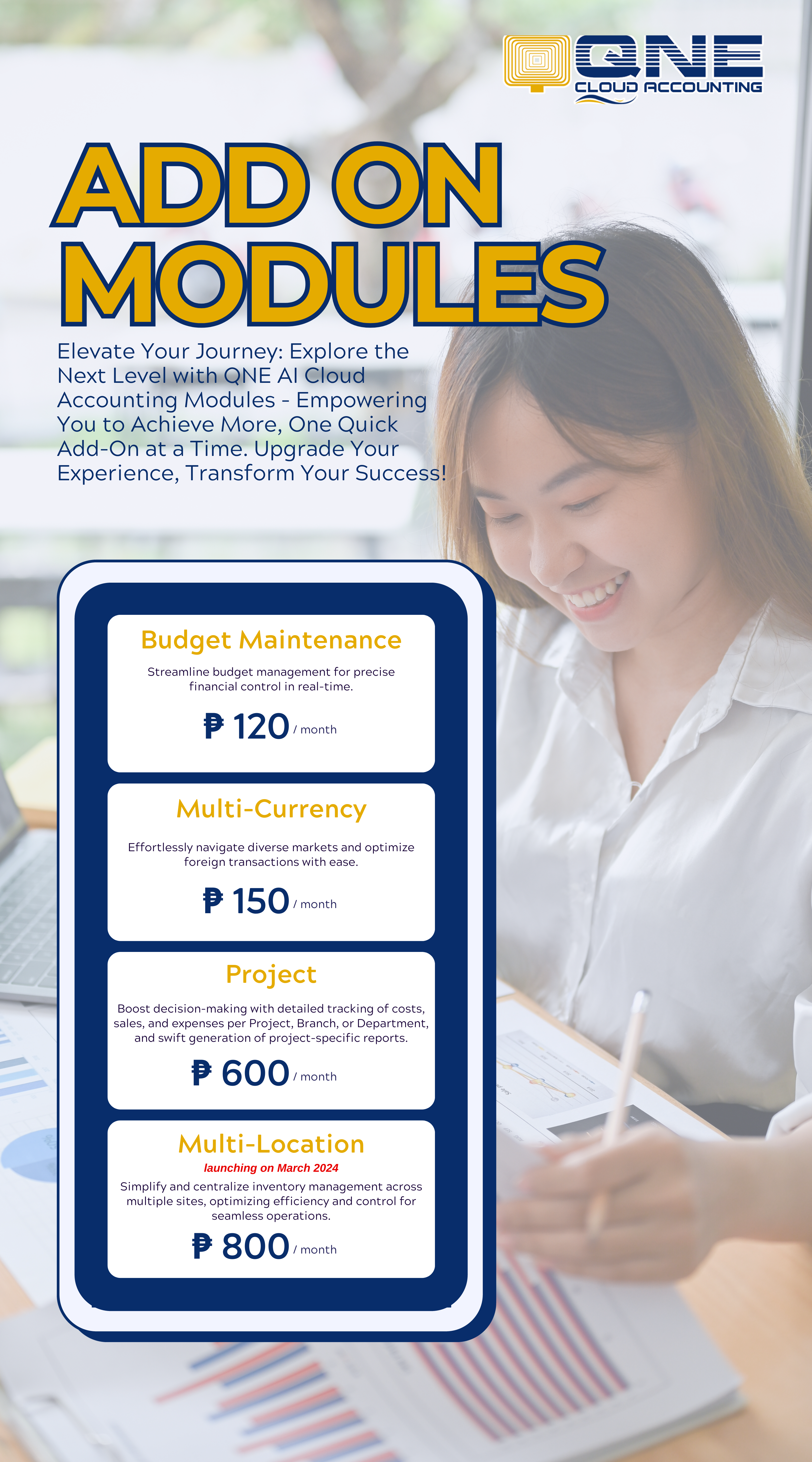

A new year is about to unfold, is your business ready to take on the new challenges? Is your accounting software BIR Ready? If so, here are the things you need to know about BIR Accounting Software.

According to the Bureau…

PUBLISHED: DECEMBER 27, 2019

A new year is about to unfold, is your business ready to take on the new challenges? Is your accounting software BIR Ready? If so, here are the things you need to know about BIR Accounting Software.

According to the Bureau of Internal Revenue, computerized accounting software is defined as the integration of different component systems to produce computerized books of accounts and computer-generated accounting records and documents. QNE Software Philippines, Inc. offers a BIR accounting software that can generate the following forms and reports in accordance with the Bureau:

- Financial Reports: General Journal, Cash Receipt Journal, Cash Disbursement Journal, Sales Journal, Purchase Journal, General Ledger, Subsidiary Ledger of Debtor, Subsidiary Ledger of Creditor, Trial Balance, Statement of Financial Position and Statement of Comprehensive Income.

- BIR Forms and Reports: Summary List of Sales (SLS), Summary List of Purchases (SLP) and Semestral List of Regular Suppliers (SRS), Relief Sales Data File, Relief Purchases Data File, QAP Data File, Annual Witholding Tax Data File (1604E) and SAWT Data File, BIR Form 2550M, BIR Form 2550Q, BIR Form 1601-EQ, BIR Form 0619-E and BIR Form 1604-E and BIR Certificate 2307.

QNE Software also assists their clients and makes sure that they pass the right documents and requirements to BIR. Now, here are the list of the requirements need to apply for Computerized BIR Accounting Software:

- Accomplished BIR Form 1900 and/or BIR Form 1907

- Photocopy of BIR Certificate of Registration

- Photocopy of Previously Issued Permit, if applicable

- Photocopy of Current Registration Fee Payment

- Location map of the place of business

- Inventory of previously approved unused invoices and receipts, if applicable

- List of branches that will use CAS, if any

- Application Name and Software used (Development and Database)

- Functions and Features of the Application

- System Flow/s

- Process Flow

- Sworn Statement & Proof of System Ownership

- Back-up Procedure, Disaster and Recovery Plan

- List of Reports and Correspondences that can be generated from the system with their description, purpose and sample lay out

- Facsimile of System Generated Loose-leaf Books of Accounts and List thereof, Receipts/Invoices

- Photocopy of previously issued permit of mother/sister company, another branch using the same system, if applicable

- Certification from Computerized System Evaluation Team (CSET) which previously evaluated the approved system, if applicable (RMO 29-2002)

Aside from the list given above, you should also make sure that your chosen accounting software is right on your budget, meets your company’s requirements, and is ready to lend a helping hand just like QNE Software Philippines, Inc.

For more information about QNE Optimum, reach us at 02 85674248 or 02 85674253 or at [email protected] or visit our website, www.qne.com.ph.