Ask for Receipt BIR Now the New Notice to Issue Receipt or Invoice (NIRI BIR) 2022

PUBLISHED: October 7, 2022

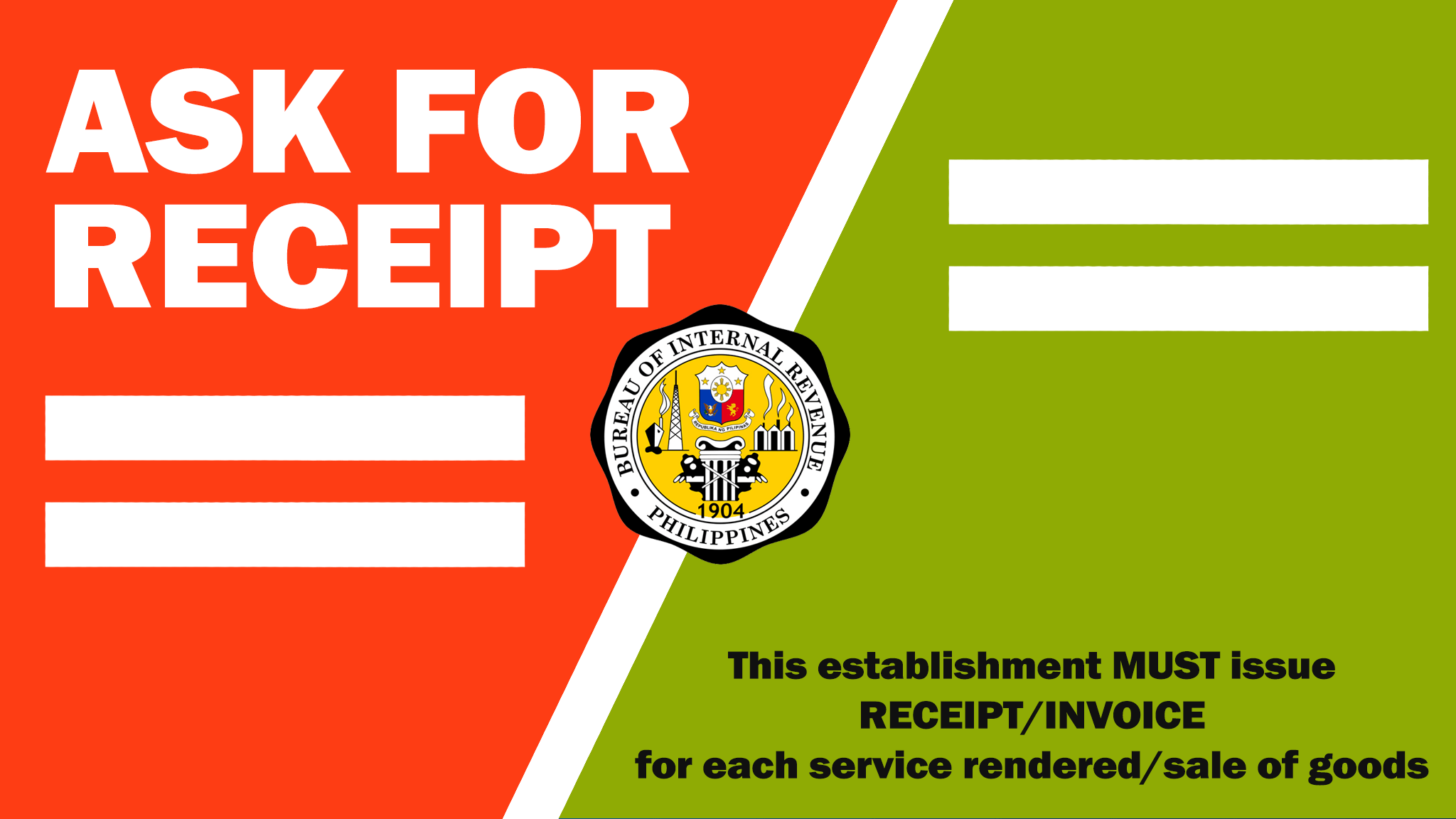

Familiar with the orange “Ask for Receipt BIR” notice by the BIR on every establishment conducting business? Well, it’s no longer orange anymore. With the new Revenue Memorandum Order No. 43-2022, the new Notice to Issue Receipt or Invoice also called NIRI BIR is now green. But aside from changing its color, it also has several new guidelines and policies that is stated in this article.

The new Notice to Issue Receipt or Invoice (NIRI BIR) requires sellers including online sellers and any person or entity engaged in selling or transacting business online to issue receipts and invoices in pursuant to RMC No. 60-2020.

Who are covered with the new Notice to Issue Receipt or Invoice (NIRI BIR)?

- All New Business Registrants (NBR) head office and branches that are registered on the Revenue District Office

- Online Sellers, Vloggers, Social Media Influencers, and online content creators earning from online platforms and advertising.

Is “Ask for Receipt BIR” notice still valid?

According to RR No. 7-2005, the “Ask for Receipt” notice that are issued to the taxpayers are still valid until June 30, 2023. The new Notice to Issue Receipt or Invoice (NIRI BIR) issuance by the BIR shall be done in accordance with the schedule of the taxpayer’s TIN ending digit, as follows:

| TIN Ending | Month |

| 1 and 2 | Beginning October 3, 2022 |

| 3 and 4 | Beginning November 2, 2022 |

| 5 and 6 | Beginning December 1, 2022 |

| 7 and 8 | Beginning January 2, 2023 |

| 9 and 0 | Beginning February 1, 2023 |

Is there a requirement for registered businesses requesting to replace their “Ask for Receipt BIR” Notice with the New Notice to Issue Receipt or Invoice (NIRI BIR)?

Registered businesses are required to update their registration information before having a copy of the new Notice to Issue Receipt or Invoice (NIRI BIR). The company shall have an official designated email address in which the Bureau will send or serve notices, orders, letters and communicate with them.

Every now and then, the Bureau is enhancing its policies and regulations help businesses streamline their operations while being government compliant. That is why business solutions such as accounting software play an important role in this age of digitalization.

If you are interested in upgrading to a BIR-Ready Online Accounting System, take your accounting to a whole new level and unleash the power of AI with QNE Cloud Accounting Software. Create your FREE Cloud Accounting Plan now!