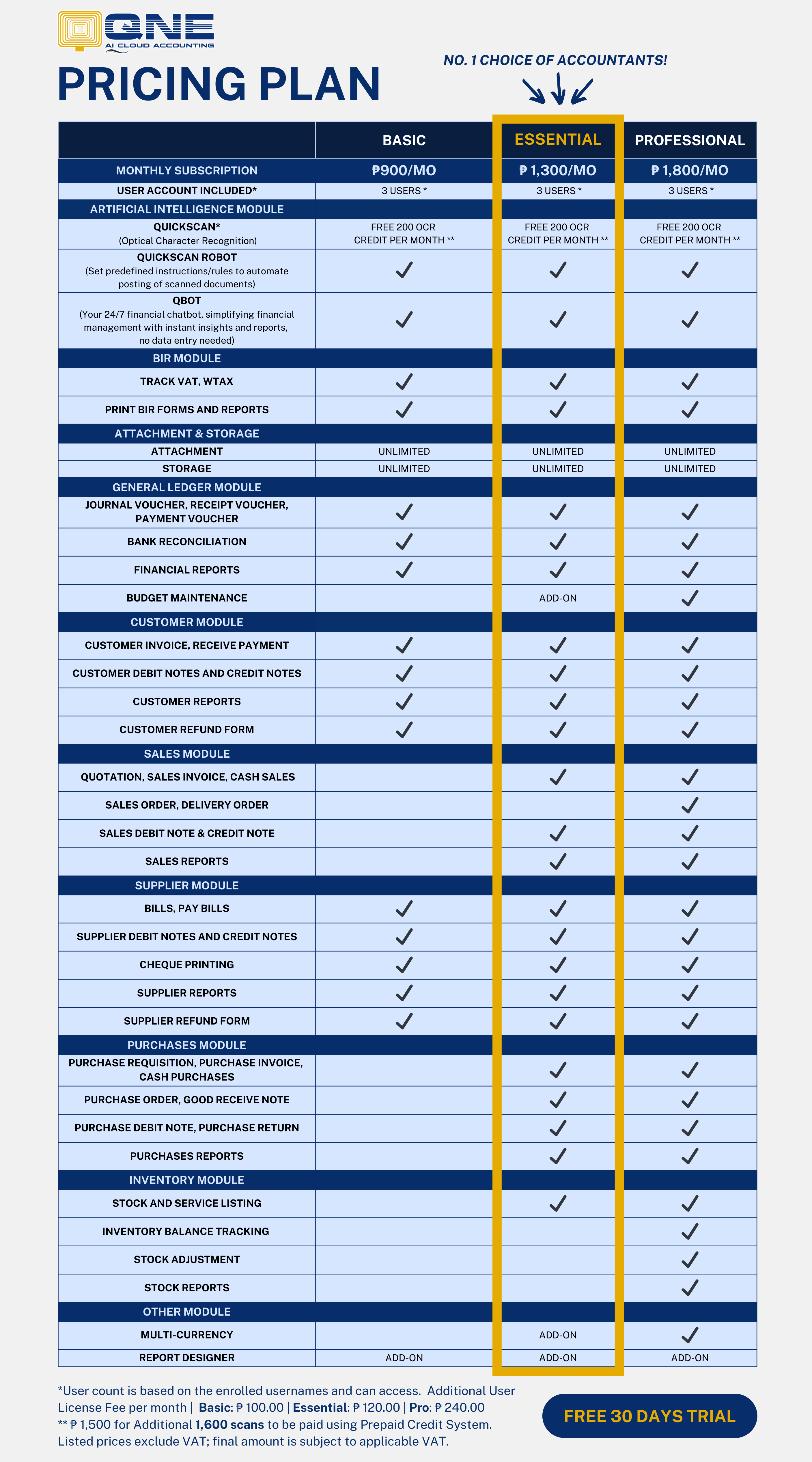

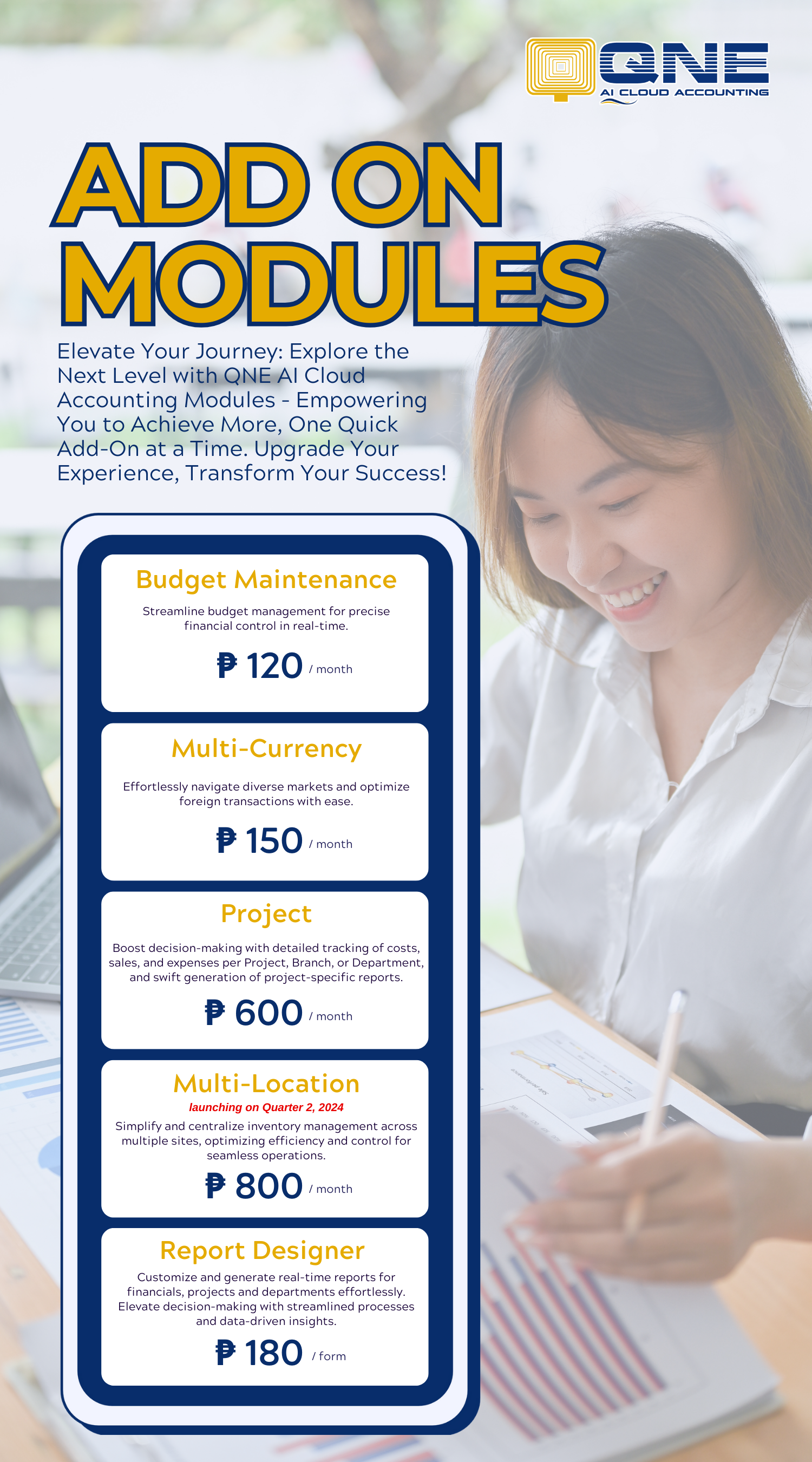

BIR Accounting Software and Payroll Software

BIR READY ACCOUNTING SOFTWARE AND PAYROLL SOFTWARE!

The No. 1 Choice of Filipino Accountants is now BIR Ready!

As a BIR Accounting Software, QNE Optimum acclimatize the local requirements which are mandated by the Philippine Government. This module includes all the present Value Added Tax (VAT) Codes by the Bureau of Internal Revenue.

BIR ACCOUNTING SOFTWARE Features AND REPORTS:

FINANCIAL REPORTS

- General Journal

- Cash Receipt Journal

- Cash Disbursement Journal

- Sales Journal

- Purchase Journal

- General Ledger

- Subsidiary Ledger of Debtor

- Subsidiary Ledger of Creditor

- Trial Balance

- Statement of Financial Position

- Statement of Comprehensive Income

BIR Accredited Accounting Software REPORT SUMMARY

- Summary List of Sales (SLS)

- Summary List of Purchases (SLP)

- Semestral List of Regular Suppliers (SRS)

BIR DATA FILES

- Relief Sales Data File

- Relief Purchases Data File

- QAP Data File

- Annual Witholding Tax Data File (1604E)

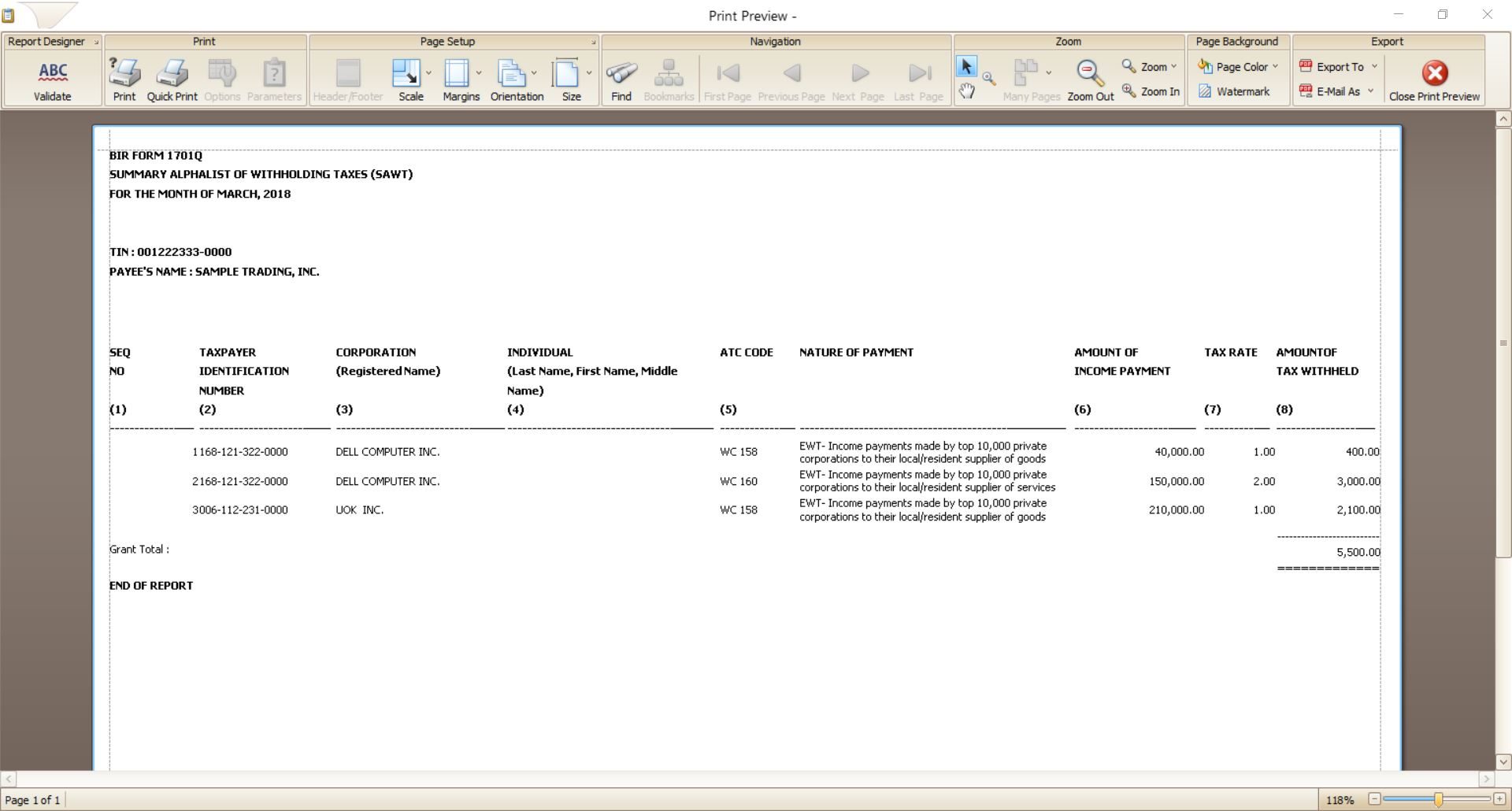

- SAWT Data File

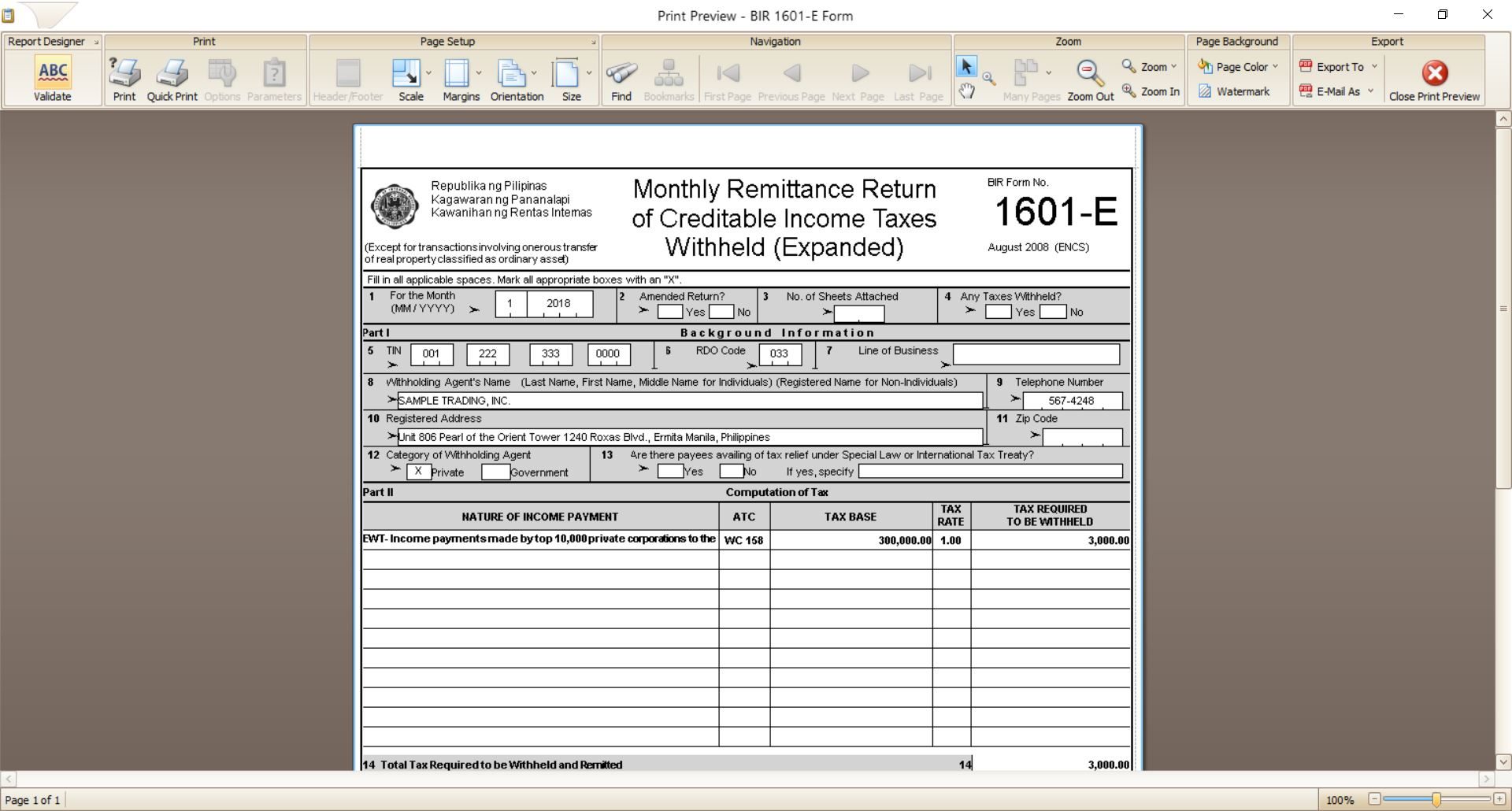

BIR FORMS

- BIR Form 2550M – Monthly Value Added Tax Declaration

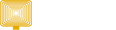

- BIR Form 2550Q – Quarterly Value Added Tax Return

- BIR Form 1601-EQ – Quarterly Remittance Return of Creditable Income Taxes Withheld (Expanded)

- BIR Form 0619-E – Monthly Remittance Form of Creditable Income Taxes Withheld (Expanded)

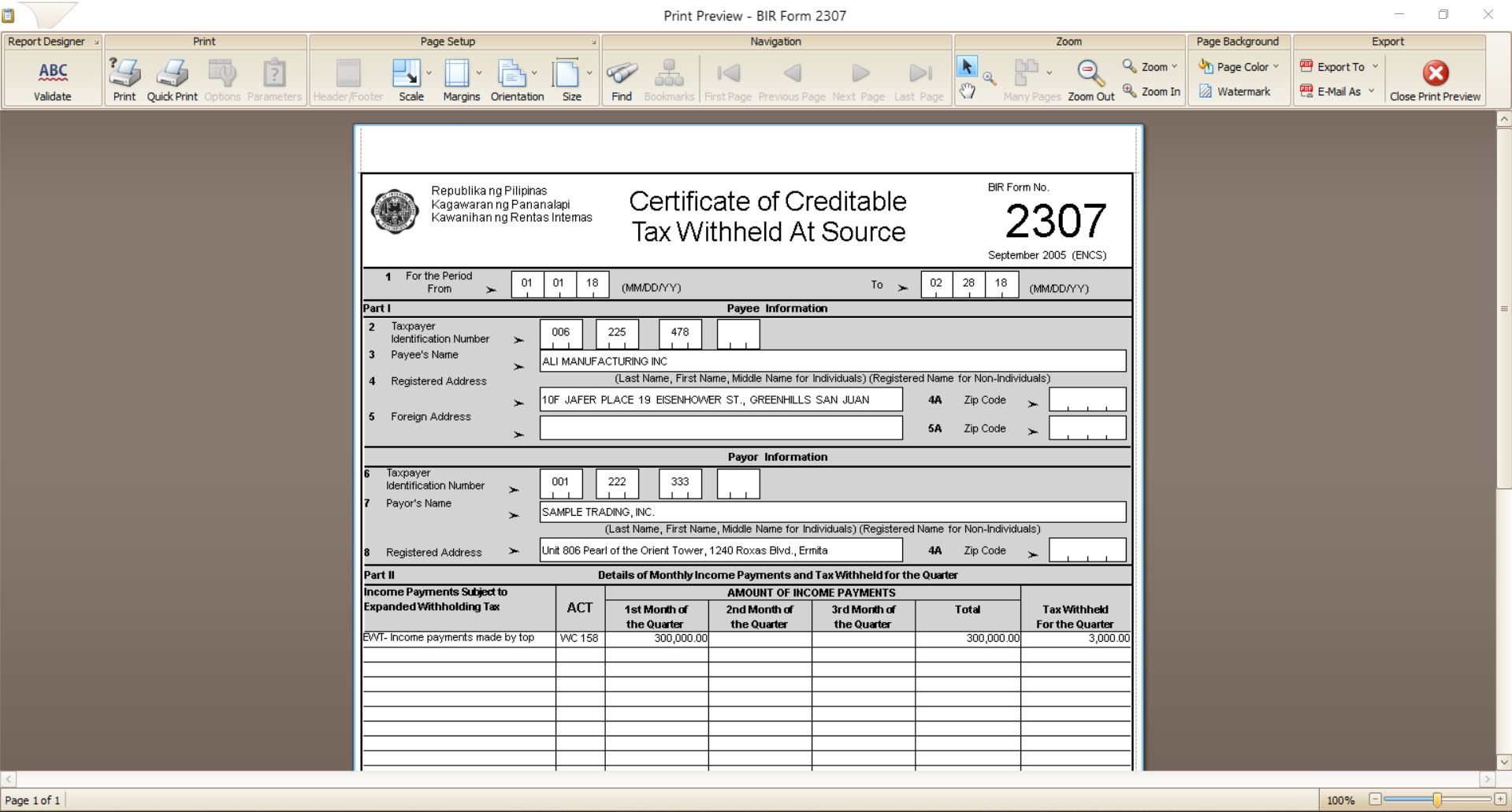

- BIR Form 1604-E – Annual Information Return of Creditable Income Taxes Withheld (Expanded)

BIR CERTIFICATES

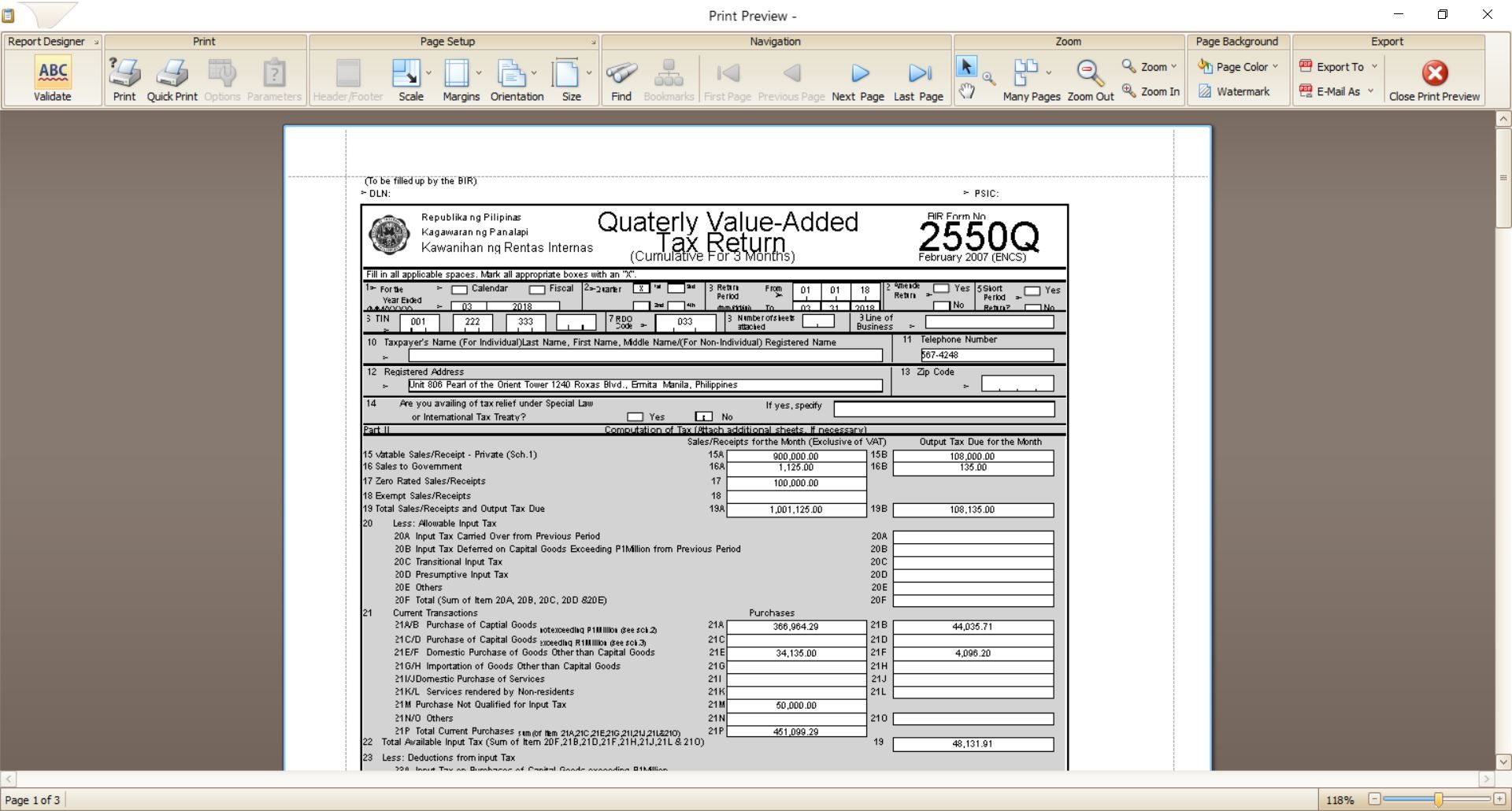

- BIR Certificate 2307 – Certificate of Creditable Tax Withheld at Source

OTHER FEATURES

- Customer Statement of Account

- Customer and Supplier Aging Report

- Check Voucher and Check Printing

- Bank Reconciliation

- Audit Trail

Below are some examples of BIR Accounting Software reports generated in QNE Optimum:

The only TRAIN Ready Philippine Payroll Software!